Signs of the Economic Apocalypse, 7-31-06

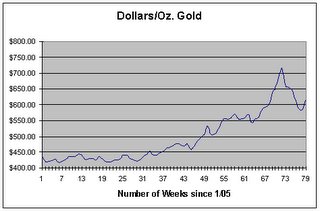

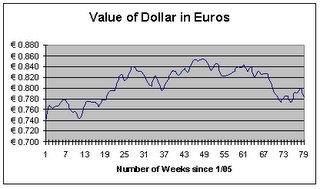

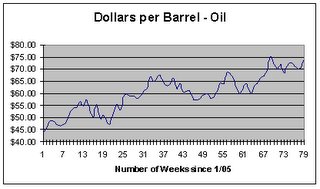

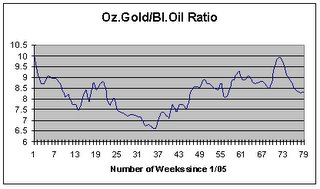

Gold closed at 646.40 dollars an ounce on Friday, up 4.1% from $621.20 at the end of the previous week. The dollar closed at 0.7837 euros Friday, down 0.5% from 0.7877 for the week. That puts the euro at 1.2760 dollars compared to 1.2695 at the previous week’s close. Gold in euros would be 506.58 euros an ounce, up 3.5% from 489.33 for the week. Oil closed at 73.36 dollars a barrel, down 1.5% from $74.43 at the end of the previous week. Oil in euros would be 57.49 euros a barrel, down 2.0% from 58.63 for the week. The gold/oil ratio closed at 8.81 Friday, up 5.5% from 8.35 at the previous Friday’s close. In U.S. stocks, the Dow closed at 11,219.70 Friday, up 3.2% from 10,876.71 for the week. The NASDAQ closed at 2,094.14 up 3.6% from 2,021.68 at the end of the week before. In U.S. interest rates, the yield on the ten-year U.S. Treasury note closed at 4.99%, down five basis points from 5.04 for the week.

Another week where a fading superpower with a decaying infrastructure, in thrall to a racist settler state, attempted to extricate itself from two losing wars by starting World War III. Again, we see that the markets have not really registered the significance of recent events but are reacting instead to short-term macroeconomic factors. So far the markets have ignored the massive war crimes ordered by criminal psychopaths in power in the United States, Israel and Great Britain. The dollar fell, but not by much, and did so out of the feeling that the Federal Reserve Board is less likely to raise interest rates. Gold rose, but it is still lower than it was two weeks ago. My guess is that the players in the oil, gold, and currency markets do not yet know how this all is going to play out. Let’s help them: Israel and the United States have already lost the war in Lebanon by the flagrant slaughter of innocent civilians, just as the United States lost the Aghan war when they bombed the first village. It may take time for events to play themselves out, but the war is lost. Israel and the United States no longer have any moral authority whatsoever (as hard as it may be to imagine now, at one point those countries did have some moral authority in the eyes of the world). And, the United States has run out of money. A currency collapse followed by a sharp drop in power cannot be far behind.

Indeed, if the professional investors won’t read the writing on the wall, it seems that the average consumer can. Oddly, that just provided stock investors with an excuse to buy. That is rational behavior for short term traders, but the indications of stagflation do not bode well for longer term stock prices:

Wary consumers snuff 2Q economic growth

By Jeannine Aversa, AP Economics Writer

Fri Jul 28, 4:47 PM ET

The economy throttled back in the second quarter as consumers and companies turned cautious amid surging energy prices. Wall Street rallied on the hope that a break in two years of interest-rate pain may be in sight.

The nation's gross domestic product advanced at an annual rate of just 2.5 percent in the April-to-June period, less than half the pace of the previous three months, according to Friday's economic snapshot released by the Commerce Department.

The first quarter's lively 5.6 percent growth rate — the fastest in 2 1/2 years — reflected energetic spending and investment by people and businesses alike.

But in the second quarter, Americans felt the pinch of $3-a-gallon gasoline prices and higher interest rates.

"This expansion is getting a little frayed around the edges because of consumer exhaustion," said economist Ken Mayland of ClearView Economics. "Consumers are losing that extra mojo to spend" now that the slowing housing market is making people feel less wealthy, he said.

Still, stocks shot up. The Dow Jones industrials gained 119.27 points to close at 11,219.70. That helped the index post its best weekly point gain since May 2005.

Spending on home building nose-dived in the second quarter, contributing to the slowdown in GDP, which measures the value of all goods and services produced within the United States.

The second-quarter's performance — weaker than the 3 percent growth rate analysts were forecasting — marked the slowest pace since the final quarter of 2005. That's when the economy, suffering fallout from the devastating Gulf Coast hurricanes, expanded at a feeble 1.8 percent pace.

Even though the economy cooled in the second quarter, inflation heated up.

An inflation gauge closely watched by the Federal Reserve showed that core prices — excluding food and energy — advanced at a 2.9 percent pace in the second quarter — far outside the Fed's comfort zone. That was up from a 2.1 percent growth rate in the first quarter and marked the highest inflation reading since the third quarter of 1994, when core inflation rose at a 3.2 percent pace.

The inflation reading was taken before the latest run-up in energy prices. Oil prices, which had hit a record high in late April, soared to a new closing high of $77.03 a barrel in the middle of July.

In a separate report mined for inflation clues, the Labor Department said employers' costs to hire and retain workers climbed 0.9 percent in the second quarter, up from a 0.6 percent advance in the prior quarter.

Federal Reserve Chairman Ben Bernanke told Congress last week that he is concerned about rising inflation, but he also said that the Fed believes moderating economic activity will eventually lessen inflation pressures.

Given that assessment, Wall Street investors and some economists believe the Fed might take a breather in its two-year-old rate-raising campaign at its next meeting, on Aug. 8.

Some economists, however, continue to predict that rates will be boosted again at the August meeting to ward off rising inflation; after that, they think the Fed may move to the sidelines.

"This whole situation creates even more of a dilemma for Bernanke, who has to weigh the clearly slowing economy against accelerating and now uncomfortably high inflation," said Mark Zandi, chief economist at Moody's Economy.com.

On the one hand, the Fed doesn't want to hoist rates too much and cripple the economy; on the other hand, it doesn't want to take a respite too soon and let inflation get out of control.

The downshift in economic growth comes as President Bush is getting low marks from the public for his economic stewardship.

Consumers, a major force shaping overall economic activity, had a smaller appetite for spending in the second quarter. They boosted spending at just a 2.5 percent pace, down from a 4.8 percent growth rate in the first quarter. Much of that weakness reflected cutbacks on big-ticket goods such as cars.

Businesses also tightened the belt.

Spending on home building fell at a 6.3 percent pace in the second quarter, the deepest dip in nearly six years. Rising mortgage rates are clipping demand.

Businesses sliced spending on equipment and software at a 1 percent pace, the first cut in just over three years.

The government also issued annual revisions that showed the economy grew at an average annual rate of 3.2 percent from 2003 through 2005, or 0.3 percentage point less than previously estimated.

The news in the U.S. housing market was bad last week:

Foundations of US housing market start to look shaky

Claire Gallen, AFP

Sun Jul 30, 6:20 PM ET

Not so long ago in parts of the United States, new homes were often sold before their foundations could be laid.

But the home boom is now showing clear signs of waning -- and analysts say that has worrying implications for consumer spending in the world's largest economy.

Most economists agree that housing demand is likely to slow further in coming months, after recent interest rate hikes and soaring energy prices. But few are predicting the abrupt bursting of an overly inflated bubble.

In the past week, a government report highlighted that the number of unsold new homes on sale across the country swelled to a record high of 566,000 last month.

And on Friday, an International Monetary Fund report said that US property prices were "overvalued", just one of the headaches facing Federal Reserve policymakers.

Homeowners have benefited from double-digit annual rises in their property values to go on a credit-fuelled spending splurge. But now the picture is changing.

"Many individuals, who signed a (purchase) contract in what they had believed was a booming housing market, may now be backing out of those contracts," said Phillip Neuhart, an economic analyst at Wachovia Securities.

"Thus, the new home market is likely weaker than new home sales reflects," he said.

Home builders report that sellers are going as far as giving away cars, free kitchen upgrades and holidays to lure reluctant buyers.

The Commerce Department on Thursday said sales of new US homes declined three percent in June to a weaker-than-anticipated annualized rate of 1.131 million units.

News of the latest sales downturn, and the record number of new homes that are languishing unsold, followed an industry report Wednesday that showed existing home sales fell 1.3 percent in June.

On Friday, the government said that US economic growth slowed to just 2.5 percent in the three months to June as consumers turned nervous in the face of sky-high fuel prices and the cooling property market.

Economists are divided on whether the Fed will raise interest rates further at its August 8 policy meeting, but agree that 17 straight hikes of its key fed funds rate have squeezed the home market and buyers' enthusiasm.

The rate has now gone up to 5.25 percent, adding to the pain for more recent home buyers who took out interest-rate-only mortgages in their rush to get on the property ladder.

University of Maryland business professor Peter Morici said that "recession risks remain real and apparent".

"With the housing market cooling, consumers are no longer able to use the equity in their homes to finance ever-larger purchases of clothes, electronics and other goods and services," he said.

Joel Naroff of Naroff Economic Advisors observed that the number of homes on the market is up an "astounding" 39 percent since June 2005.

"From the huge jump in the housing inventory, it appears that anyone who has any hope of getting out has put their home on the market," he said.

Even housing market representatives say that sellers are no longer commanding the handsome premiums of recent years, as prospective buyers take longer to sign on the dotted line.

"Relative to the five-year housing boom, this year is a buyers' market in much of the country," observed David Lereah, the chief economist of the National Association of Realtors.

The government's latest figures support Lereah's outlook, but prices still remain stratospheric in some hot urban areas.

The median price for a new home fell 1.6 percent last month to 231,300 dollars from May. But buyers in New York, San Francisco and Washington would be lucky to find a family home for sale at double that price tag.

The increasing pessimism of the general public, fueled in part by high fuel prices and a shaky housing market, cannot be good for the economy. This pessimism is no doubt also fed by the frightening news out of the Middle East. It also may be fed by the unmistakable signs of global warming recently, including record high temperatures throughout the northern hemisphere and more severe storms with much higher rainfall. Fears of the consequences of climate change are exacerbated by the decaying social and material infrastructure in the United States.

Record heat, violent storms beleaguer US cities

150,000 in St. Louis still without power

By Cezar Komorovsky and Debra Watson26 July 2006

Record-breaking heat continues in widespread areas of the contiguous United States, which, combined in many cases with official neglect and mismanagement, has produced considerable misery and social disruption. Power outages and lack of air-conditioning have led to deaths in several cities.

Unusually high temperatures in the US have forced thousands without air conditioning to flock to makeshift cooling centers to avoid the soaring temperatures. Twenty-nine deaths have been attributed to the heat wave in recent days. Seven deaths have occurred in Chicago, mostly among the chronically ill and elderly. One elderly man’s death in northern California was attributed to an air conditioning failure in the nursing home where he lived.

Four people died in St. Louis, Missouri after heavy rainstorms last week multiplied the debilitating effects of a heat wave that has gripped the metropolis.

A fifth victim in the St. Louis area, utility worker Robert Tackett, was electrocuted July 25 in a city suburb when he walked into brush where a live wire was hidden. Tackett, 56, a 13-year veteran at AmerenUE, who was working on restoring power to the more than 100,000 people still without electricity in the area, was killed instantly. Also on Tuesday, a contract worker with Kansas City-based Par Electric came into contact with an energized line in north St. Louis County. Hospitalized, he was expected to recover.

Every major metropolitan area west of the Rocky Mountains experienced record heat over the weekend. Phoenix, Arizona hit 114 degrees Fahrenheit (46 degrees Celsius) and Los Angeles 101 degrees (38C), while temperatures in Woodland Hills, California—a Los Angeles suburb—reached 119 degrees (48C) on Saturday. Rolling blackouts are expected in California as demand for electricity spikes. The National Weather Service has issued a new excessive heat warning for California, with temperatures predicted to reach 111 degrees (44C).

Wildfires, fueled by the dry, hot conditions, continue to rage in a number of areas, particularly in rural parts of San Diego County in southern California and in the Tonto National Forest in Arizona, east of Phoenix. Fires have already devastated over 4.9 million acres in the US in 2006, considerably more than the 10-year annual average of 2.7 million acres. The National Interagency Fire Center reported July 24 that this fire season was on pace to be the worst of the decade.Eastern cities have not escaped major power outages. Thousands of homes and businesses in the New York City borough of Queens have been without electricity for more than a week. (See “The Queens blackout: the brutal human costs of Con Ed’s drive for profit”).

St. Louis, in the country’s mid-section, has been hardest hit by power outages. Nearly a week after summer storms punctuated a severe heat wave, some 150,000 residents were still without power Monday, out of a metropolitan area population of approximately two million people. The city has been declared a federal disaster area, and the governor has called out the National Guard.

The storms July 19 and July 21 did more than impact the electrical grid. Many homes, businesses, streets and roadways were damaged or covered in debris. Heavy rains, powerful winds of up to 80 miles per hour and lightning left behind neighborhoods with damaged buildings and houses due to fallen trees and branches, giving the appearance in certain areas of a war zone.

The first storm knocked out power to more than 500,000 Ameren customers; the second storm affected 200,000, including many whose power had barely been restored.

The storms compounded the effects of the already deadly heat on area residents. Temperatures in the St. Louis area have been hovering around or above 100 degrees Fahrenheit. Temperatures for the year are above normal and are expected to remain so for the rest of the week, reaching the 90s until at least Friday.

Hospitals and nursing homes were evacuated the day after the first storm. On July 20, St. Louis City firefighters evacuated about a hundred senior citizens from an assisted living complex. The residents had been without power throughout the previous night. But scores of other frail individuals were simply left to fend for themselves, unable to get to one of only two shelters or 14 cooling centers available in the city. One family that stayed in their home suffered carbon monoxide poisoning from running a generator inside their home in the blacked-out city.

By July 21 many streets and subdivisions in St. Louis County appeared abandoned, as residents took shelter in the South County Mall and other nearby shops. Many store parking lots were near capacity by noon, and long lines of cars and trucks congested gas stations.

St. Louis, the 17th largest metropolitan area in the US and the third largest in the Midwest, has a poverty rate of nearly 21 percent. The official (and underestimated) unemployment rate is 10 percent. Those with the worst health complications disproportionately fall into the ranks of the poor, without financial means to remedy their situation, or even to avoid a weather-related disaster. The social chasm renders precarious the lives of large numbers of people living in poverty.

On Monday Ameren officials were dismissive of residents’ desperate pleas for help. The utility company spokesperson said customers should have expected to wait three to five days for power to be restored.

The St. Louis Post-Dispatch’s web site noted, “While many customers without power remain hopping mad, St. Louis Mayor Francis Slay and Missouri Gov. Matt Blunt offered only mild, if any, criticism of Ameren at a news conference Monday.”

“They’re under a lot of pressure. They’ll remain under pressure to restore power,” Blunt told the media. “We’ll worry about any sort of after-action after power’s been restored to everybody that was impacted.” He added, “No response is perfect.” Republican Senator Jim Talent also praised Ameren’s recovery efforts.

The mayor of Bethalto, Illinois, however, across the Mississippi River from St. Louis, called for an inquiry into Ameren’s prioritizing of its efforts to restore power. Mayor Steve Bryant told the media that residents of his town weren’t seeing Ameren trucks, and that on Monday morning, three-quarters of Bethalto residents were still without power.

In a nice touch, Ameren had applied to the Missouri Public Service Commission July 7 for an increase in basic rates for electric service. The filing included a proposed average increase in electric rates of 17.7 percent, with a limit on the increase to residential rates of 10 percent.

In St. Louis proper, with a population of 350,000, chaos was evident as last week’s storms progressed. On the night of July 19, after the first storm hit, angry residents lined up at the few open gas stations. People scrambled for ice and drinks or anything else they might use to stay cool. Ice remains in short supply nearly a week after the blackout began. “Gas prices are going through the roof. Nobody’s got electricity. There’s not a single bag of ice in there. It’s like the end of the world,” resident James Burkett told the Post-Dispatch on Saturday.

While heat took the lives of two of the storm’s victims, one death associated with the storms was attributed to a downed power line in a public housing complex in impoverished East St. Louis, Illinois on the morning of July 20. Chester Chapman, 50, was electrocuted while walking from his home in the complex to a nearby vocational school, according to St. Clair County Coroner Rick Stone.

The mayor of Cahokia, Illinois said at least 50 homes had trees on them. Without power in the city on Saturday, the sewage treatment plant was affected.

Many of the storm and heat-related problems in the Midwest, where tornadoes and thunderstorms are common, could be averted if efforts were made to replace antiquated above-ground power lines with an underground system, thus ensuring their safety in violent storms.

The United States Federal Emergency Management Agency (FEMA) is getting a good start in preparing for this year’s hurricane season by instituting cuts in future emergency payments to disaster victims:

US: FEMA slashes emergency assistance for future disaster victims

Family payments to be cut from $2,000 to $500

By Kate Randall28 July 2006

A month and a half into the 2006 hurricane season, the US Federal Emergency Management Agency (FEMA) has announced an overhaul in core disaster relief programs. The biggest change is a sharp cut in emergency cash assistance to families, which will be slashed under the new rules from the $2,000 previously allowed per household to $500.

In addition, states are being asked to foot 25 percent of the bill for the emergency cash, which will only be provided after an affected state signs off on the program. Other changes include more stringent identification of recipients and direct payment of emergency hotel and rental fees to property owners.

Payments to evacuees will no longer be made via debit cards, which FEMA says created conditions for fraud, but will made either by check, direct deposit to recipients’ bank accounts or in cash. The new guidelines take effect immediately.

The cuts are being justified by FEMA as an effort to curb abuse of aid by disaster victims. A Congressional audit of the emergency funds distributed last year following Hurricanes Katrina and Rita estimated that $600 million to $1.4 billion of the $5.4 billion in assistance may have been based on fraudulent, inaccurate or improper claims. FEMA’s response to the alleged abuse is to punish future disaster victims, as well as further burden the budgets of states still reeling from the effects of last year’s catastrophe.

FEMA director R. David Paulison, who took over after the resignation of former head Michael Brown, heavily criticized for his miserable performance following last year’s storms, expressed the federal government’s disregard for the effect the changes will have on future hurricane victims. “This is still going to be a compassionate organization,” he stated. “We simply have to do a better job of protecting the tax dollar.”

Paulison maintained that the cutbacks should not seriously affect evacuees, and that the money is only intended as a “stopgap” measure in any case. He further added—echoing the Bush administration’s perpetual promotion of “personal responsibility”—“When they have a lot of money, the temptation out there is to spend it.... When they receive a small amount at first, they will spend it on what they really need.”

While acknowledging that large households would receive the same amount as smaller ones, he dismissed suggestions that the funds would not be distributed equitably and said that provisions existed for dispersal of additional payments under extreme circumstances.

David Garrett, FEMA director of recovery, in response to criticisms of the cuts, commented that the funds are not intended to cover the cost of shelter, but are for emergency needs such as food, clothing and fuel. “Very few people need $2,000 to take care of those expenses for a week,” he claimed arrogantly. Critics have pointed out that tens of thousands of Katrina evacuees were displaced for weeks on end and lost everything. For a family of any size under these conditions, $2,000 is a small amount to cover such necessities.

The proposal for states to pay 25 percent of these emergency financial payments was met with widespread opposition by state authorities, particularly in Louisiana, the state hardest hit by Katrina. In 2005, the federal government paid all of the $1.5 billion in expedited assistance for Louisiana evacuees. Under the new regulations, the state would have had to pay $375 million.

The FEMA overhaul was also not discussed with state officials in advance, but presented as a fait accompli. Mark Smith of the Louisiana Office of Homeland Security and Emergency Preparedness, commented, “Historically, FEMA doesn’t make major changes until it’s at least talked to the states and tried to assess the impact. That hasn’t been done yet, and these changes need to be stopped in their tracks.”

FEMA officials have shrugged off such criticism from the state governments. Director Paulison reiterated that if the states were unwilling to commit to contribute a quarter of the funds, they would not get anything. “It’s their citizens,” he said during a news conference at FEMA headquarters. “If they don’t agree to it, we won’t do it.”

Mark Smith countered in a comment quoted in the New Orleans Times-Picayune, “If a catastrophic event like Katrina hits a poor state like Alabama, Mississippi or Louisiana, they most assuredly won’t be able to pay and the people will suffer. They are citizens of their states, but they are also citizens of the United States. Is [Paulison] saying the federal government will turn its back on its citizens, its taxpayers?”

Under the new rules, states will also not be reimbursed for the entire cost of debris cleanup done by the U.S. Army Corps of Engineers. The new rate will be either 75 percent or 90 percent of the total cost.

Other aid-program changes involve more careful identification of aid recipients. FEMA will begin registering people for assistance before a storm makes landfall, entering their names into the agency’s database to check their information. FEMA has contracted with ChoicePoint, a national data broker, to assist in recipient identification.

ChoicePoint does not come to the project with a distinguished record. Last year the company announced that it had mistakenly sold personal data on 145,000 people to identity thieves, and was fined $15 million by the Federal Trade Commission. Any mistakes in ChoicePoint’s cross referencing could result in legitimate victims being denied aid.

All these reasons for consumer pessimism put the U.S. Federal Reserve Board in a terrible position. They need to raise interest rates in order to prevent a wholesale currency collapse in the world’s reserve currency. But to continue to do so will destroy the engine of world economic growth: the borrow-and-spend habits of the U.S. population. Here’s Gary Dorsch:

The Fed’s Dilemma, Defend the US Dollar or US Home Prices

A slowdown in the US housing market is thought to have been a big reason why US retail sales fell 0.1% in June. Re-sales of single-family homes fell 1.5% in May to an annual rate of 5.82 million. Buyers are discouraged by 30-year mortgage rates that rose to 6.71% last week, the highest since May 2002. The supply of existing homes rose 5.5% to 3.6 million units or 6.5 months’ worth at the end of May.

Up to 40% of US home loans were of non-traditional types such as adjustable rate and no-money-down mortgages in 2005. "Some people will soon be faced with adjustable rate loans re-pricing under less favorable conditions," said Chicago Fed chief Michael on May 18th. Another Fed rate hike to 5.50%, would put a greater crunch on Americans who are borrowing more and saving less to support their shopping habits. The US personal saving rate as a percentage of disposable income, slipped to a negative 1.7% in May.

Housing accounted for a third of total US growth and about half of private payroll jobs created since 2001. Fed data shows home price appreciation helped add $5.2 trillion to consumers' balance sheets during the current expansion, or 68% of all wealth creation. So further rate hikes by the Fed to fight inflation carries a big risk of tipping the US economy into an outright recession.

The last three Fed rate rates under Bernanke’s watch, were initiated in defiance of an inverted yield curve, and did tremendous damage to US homebuilder shares. Fed officials have downplayed the predictive powers of the yield curve, and have pressed on with the rate hike campaign to defend the US dollar from speculative attack, and to contain surging gold and commodity prices. But after a 50% correction in the DJ Homebuilder index from record highs in August 2005, bargain hunters are sifting through the rubble of the once high-flying US housing sector.

As for the Fed’s next move on August 8th, the odds favor a pause in the rate hike campaign at 5.25%. Politics is becoming a key consideration now. A Bloomberg/Los Angeles Times poll on June 27th, showed by a 65% to 22% margin, that Americans oppose another rate increase by the Fed, worried about the value of their homes, and rising mortgage payments on variable loans. Therefore, the politically correct modus of operandi is to maintain a steady fed funds rate at 5.25% in August.

Interestingly, Dorsch claims that the recent stabilization of gold prices are evidence that traders believe that the Israeli invasion of Lebanon will not spread to Syria or Iran:

Gold has been on a wild rollercoaster ride this year, mostly tracking the direction of global stock markets for real-time clues about the health of the global economy and inflationary pressures. With the initial outbreak of war between Hezbollah and Israel, gold detached itself from the MSCI World index in mid-July, with the yellow metal moving higher, while global stock markets were tumbling lower.

After peaking at $675 on July 17th however, the fortunes of gold and the MSCI world index reversed, with gold sinking to as low as $600 /oz, and global stock markets rebounding higher. The reversal of fortunes was based on the perception that the Lebanon war won’t spread to Iran and Syria. After all the see-sawing, both gold and the MSCI World stock index have moved back into alignment. At other times, gold has tracked crude oil prices, blurring the focus of gold traders.

According to Dorsch, oil prices are where to look for reaction to the new round of destabilization of the Middle East:

Crude Oil and the Middle East Powder-keg

Bernanke is playing a dangerous poker hand by gambling on steady oil prices. Crude oil has entered into un-chartered territory, with prices climbing above psychological barriers, such as $50, $60, and $70 per barrel, then establishing these levels as a base of support, before mounting rallies into higher ground. Markets don’t trade in a straight line, they usually move up and down within a trend. Crude oil has been marching higher in an orderly fashion since the US conquest of Iraq, fueled by a razor thin difference between global supply and demand.

One wonders at the confidence of the traders that the war won’t spread to Syria and Iran. The neocons in the United States and Israel have been telling everyone who will listen that they plan to overthrow the regimes in Syria and Iran, and so far they have been able to implement every step of their plans, even when the previous steps have seemingly failed.