Signs of the Economic Apocalypse, 1-2-07

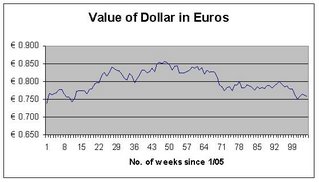

Gold closed at 638.80 dollars an ounce Friday, up 2.7% from $622.30 at the close of the previous Friday. The dollar closed at 0.7576 euros Friday, down 0.5% from 0.7617 at the close of the week before. The euro closed at 1.3199 dollars Friday compared to 1.3128 the Friday before. Gold in euros would be 483.98 euros an ounce, up 2.5% from 474.02 for the week. Oil closed at 61.05 dollars a barrel Friday, down 2.2% from $62.41 at the close of the Friday before. Oil in euros would be 46.25 euros a barrel, down 2.8% from 47.54 at the end of the week before. The gold/oil ratio closed at 10.46, up 4.9% from 9.97 for the week. In U.S. stocks, the Dow closed at 12,463.15 Friday, up 1.0% from 12,343.22 at the close of the week before. The NASDAQ closed at 2,415.29 Friday, up 0.6% from 2,401.18 for the week. In U.S. interest rates, the yield on the ten-year U.S. Treasury note closed at 4.70%, up eight basis points from 4.62 at the close of the week before.

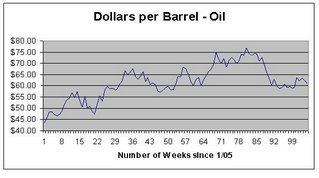

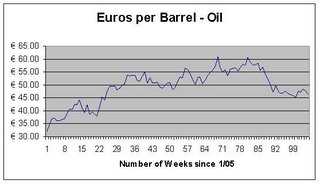

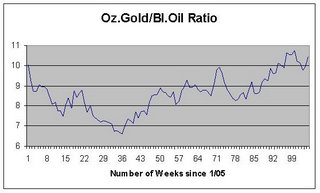

Since Friday was the last trading day of 2006, let’s look at some year and quarter to date statistics. Gold rose 22.9% from $519.70 to $638.80 an ounce for the year in dollars and 5.8% from $603.60 for the fourth quarter of 2006. The dollar dropped 11.4% from 0.8440 euros to 0.7576 euros for the year and 4.1% from 0.7890 euros for the quarter. Gold in euros rose 10.3% from 438.60 to 483.98 for the year and 1.6% from 476.25 for the quarter. Oil in dollars went from $61.04 a barrel to $61.05, virtually unchanged. For the quarter it dropped 3.1% from $62.91. In euros, a barrel of oil dropped 11.2% from 51.43 euros to 46.25 for the year and 7.3% from 49.64 for the fourth quarter. The gold/oil ratio rose 22.9% from 8.51 to 10.46 for the year and 9.1% from 9.59 for the quarter.

In the U.S. stock market, the Dow Jones Industrial Average rose 16.3% from 10,717.50 to 12,463.15 for the year and 6.7% from 11,679.07 for the quarter. The NASDAQ rose 9.5% from 2,205.32 to 2,415.29 for the year and 6.9% from 2,258.43 for the quarter. The yield on the ten-year U.S. Treasury note rose 31 basis points from 4.39% to 4.70 for the year and 7 basis points from 4.63 for the quarter.

Here are some charts going back to the beginning of 2005:

A story for 2006 was the rise in the price of gold, not just against the dollar (23%) but also against the euro (10%) and against oil (from 8.5 barrels of oil for an ounce of gold to 10.4). The U.S. stock market did well in dollar terms but not so well when pegged to euros or gold.

The big story, though, is that they managed to keep the world economic system as we have known it in recent decades intact. There are signs, though, that those running the economy are worried. Actually, the very fact that they have kept the economy together during this time of world crisis accompanying the on-going collapse of the U.S. empire, speaks to the concern among the elite about popular opposition to the neoliberal project and to the U.S./U.K/Israeli imperial genocidal wars.Tripping Over 11.5% Inflation

…If you have recovered from eggnog overdoses, you'll remember that I pointed out yesterday that gold has gone up this year more than the Dow and silver lots more.. And, if we count back from the March 15 area mentioned for about a year in predictive linguistics runs from http://www.halfpasthuman.com/, the 55-days average from market peak to crash, then we could very easily be in the vicinity of all-time highs right now.

It's with this in mind that we can scan the headlines and ask "Is inflation a really good thing, really bad thing, or about neutral?" Damn fine question. Warm up the coffee, this is a little complicated.

Inflation is a bad thing - a very bad thing - if you are on a fixed income. Two classes of people are being screwed by inflation which is running so far above "official government rates" as to be laughable. The retired military and the retired social security pensioners. Also, people on pensions which are tied to "official" cost of living numbers.

Inflation is a good thing if you are a borrower, though. You borrow expensive money and pay back with watered down money - deflated money.

In a balanced investment strategy, you try to maintain the actual purchasing power you had at the time you made an investment, plus a little actual gain. Do that, consistently, and you're a genius.

Government uses phony inflation numbers driven by specific measures of the money stocks (M1 and M2) but the broadest measure of the money supply, M3 was discontinued by the Federal Reserve back in March because it would scare the hell out of people.

The problem, monetarily, seems to me to boil down to this: Inflation (which you might estimate as being the relationship of the number of dollars in circulation compared with the value of available goods and services) is commonly thought of as having something to do with Gross Domestic Product versus cash money in circulation.

GDP

M1 = inflation.

The wholly fraudulent notion is that inflation relates to just cash. Of course, it doesn't. It relates to all effective money in circulation - and how fast it turns over and that fist number is M3 and the second is velocity.

Ignoring velocity of money to keep this simple, while M1 shows a very tame rate of increase lately, M3 is going through the roof, although you're not supposed to notice because the Fed knew this was coming and has hidden the numbers from public sight, lest we would all figure out the crookedness of the game.

Still, in the past few days, Bart over at NowandFutures.com has updated his (and John William's) work on M3B, a 99.9% or better estimation of what M3 would be if the Fed decided to be honest, and it show real M3.

Care to take a guess at what M3 inflation is running annualized right now? I'll make this easy for you:

11.5%

"Hmmm...that seems to be close to what my grocery bill has gone up, along with the power bills...how come government isn't telling us this?" Plausible deniability, pal.

Here's how the Big Con works. Say that you knew that money creation was slipping out of your control and that you could only influence how the economy developed by setting a few key interest rates. And suppose further than money is effectively created by non-government players who offer credit and creative financing to keep their games growing. "Are you talking about the housing industry, especially the sub primate guys and the big derivatives players who create loans out of air?" Duh. Yeah, the coffee is working.

OK, the second part of the Con is that most people have been slowly, but steadily renouncing the use of cash in favor of digidollars. Credit cards, etc.

Now, run up to the china board and write this down somewhere:

GDP/M1 = and approximation of government reported inflation. BUT

GDP/M3 (which is really digidollars) = an approximation of actual inflation.See how this works? Government has deniability, as they would argue that they use M1, which would be fine if the real estate boyz and derivatives players weren't making money all day hand over fist through the process of loan creation. A splendid damn miracle. And government - having hidden M3 where it can't see daylight can argue "Ain't no measure of digidollar inflation...that's all speculative." Not in Texas, though. I see the proof at Brookshire's, Kroger's, Wal-Mart, Tractor Supply, just as you'll find it at Wynn-Dixie and Safeway.

So, now that you know that inflation (M3/digidollar basis) is going up 11.5%, how does the Dow look for the year? Let's pencil it out.

We start the year at call it 10,717 and we bump that up by 11.5% this week to just maintain purchasing power parity (PPP). That means the Dow's equivalent in digidollars at the beginning of the year could be argued to be in the vicinity of 11,949. Given the market's close yesterday and outlook for another run up today, let's say the Dow is really up for the year on a purchasing power basis about 3.9%.

On a PPP/digidollars basis, I'd argue that gold, starting from $516.60 would correct to $573.43 versus its $626.80 level at press time this morning. That's a 9.3% gain on a PPP/digidollar basis as of this morning.

Somehow I got off track. Let me get back on it by telling you (as I have told Peoplenomics subscribers for several years) that while the last Depression was arguably touched off by competitive tariffs, today's Second Great Depression is being set up one level upstream from direct tariffs by competitive currency devaluations.

Now, let's haul out some headlines to underscore how (thanks to the media not differentiating between PPP/digidollar inflation and M1 cash inflation) we could almost get the sense that the US is doing better than the rest of the world in efforts to contain inflation.

We look first at Japan. The headline there today is that the inflation rate increased in November and jobless numbers hit an 8-year low. Sounds sort of familiar, huh?

South Korea's inflation rate has increased in December.

Vietnam's inflation for the year is 6.6%

Serbia's Central Bank says inflation is below 7% now.

Inflation in Russia is running at 8.2% year to date.

On the other hand, China is looking at a 3% inflation rate for 2007 - pretty damn tame compared with US actual rates.

What's key here (and for subscribers why we watch the Global Index of multiple markets so closely) is that there is a huge competitive global inflation underway and when you read about inflation in the oil-rich Gulf Countries (where rents in some have gone up 80% since 2005) you can see clearly why OPEC doesn't have a problem raising its price. They are feeling the impacts of inflation which is robbing them of oil revenue purchasing power. They're screwed, in fact in PPP, if they don't raise oil prices!

As long as the competitive devaluations continue, a sort of economic equivalent to the music continues in musical chairs, everything is dandy. But, as soon as predictability ends, the world's going to be in a heap-o-trouble and you'll want a portfolio structured to insulate you from real declines in purchasing power, which is what investing is all about. Wealth preservation.

When the market goes up and gold goes up in tandem, think "Global competitive currency devaluations."

Financial Times cautions the “plutocrats”

By David Walsh

29 December 2006

The Financial Times, Britain’s leading financial newspaper, published a remarkable editorial December 27 entitled “Seasonal cheers for new philanthropists.”

The piece praised wealthy individuals such as billionaire investor Warren Buffett, Microsoft founder Bill Gates, Hank Greenberg as well as other executives at insurer American International Group, and Swiss millionaire Klaus Jacobs for donating large sums of money to various charitable and educational causes.

The Financial Times hailed Buffett, whom the newspaper called “an anti-Scrooge,” and the others for “getting rid of their wealth” and thereby offering an answer “to the inequalities caused by globalisation,” as well as “shaking up the cushy world of charitable foundations.”

After detailing what it considered the innovative strategies of Gates, Buffett and their wealthy fellow philanthropists, the editorial got to the heart of the matter, asserting that an “important effect of philanthropy by the rich is to make their wealth more acceptable to the rest of society. Globalisation and new technology that has displaced many white- and blue-collar jobs have led to rising inequality both within countries and across the globe. The richest 1 per cent of Americans now garner about 16 per cent of national income: double what they earned in the 1960s.”

In addition to the overall global figures on inequality, the FT editors were likely responding to hostile public reaction to the massive bonuses announced this month in New York and London by Goldman Sachs and other securities firms for their top traders—financial rewards that run into the tens of billions of dollars. Or to well-publicized cases such as Lee Raymond, former chairman and CEO of ExxonMobil, who walked away at the end of 2005 with a $400 million compensation package.

Polls indicate that more than 80 percent of the US population thinks corporate executives are overpaid.

If only more of the super-rich would act in the farsighted manner of Buffett, and give away a portion of their riches, argued the Financial Times, the social chasm between the elite and the broad mass of the population would be “more acceptable” to the latter.

The editorial continued, “Plutocrats can spend all their money on mansions, yachts and servants, but if they do so, then pressure for higher taxes and collective labour bargaining will return and grow. Great wealth is often the result of great talent. But it is also a privilege granted by the rest of society and, if it is abused, society will not hesitate to take it away.”

The use of the word “plutocrat” is noteworthy, coming from vigorous defenders of capitalist “democracy.” The dictionary definition of a plutocrat is “a member of a wealthy ruling class” or “a person whose wealth gives him control or great influence.” A plutocracy means simply “government by the wealthy.”

The newspaper’s editors, whether they realize it or not, are acknowledging that Britain and America are societies ruled by financial oligarchies.

The warning—“society will not hesitate to take it away”—is stark, coming from one of the leading financial organs in the world. The newspaper is cautioning its own class that the grotesque accumulation and flaunting of wealth are generating resentment and anger, which, if not checked, will ignite a social upheaval, even a revolution, in which the upper echelons would lose everything.

Of course, the editors’ solution, greater philanthropy by the plutocrats, is no solution at all. There is something intrinsically demeaning, whatever the intentions of the donors, about the concept of philanthropy, since it tacitly accepts the existence of social and economic inequities and the subordinate position of the vast majority of the people vis-a-vis a moneyed elite.

The very fact that the newspaper feels obliged to lecture the modern-day financial aristocrats is indicative of a deeply unhealthy and dysfunctional state of affairs. Taking into account the social and moral makeup of the global nouveau riche, it is, moreover, safe to predict that the Financial Times’ recommendation will fall largely on deaf ears.

That a Buffett or Gates has tens of billions of dollars in private wealth to donate is an indictment of the existing social order. Their largess is possible only as the result of the build-up of poverty and misery at the other pole of society. Some 1.1 billion people in the world currently live on less than $1 a day, and some 3 billion on less than $2. Sixty million people in the US, the richest country on earth, subsist on less than $7 a day!

Far more perspicacious than the FT editors, who blandly suggest that great talent often produces great wealth, the novelist Balzac observed that behind every great fortune lies a great crime.

Oscar Wilde dissected the mechanism of charity and philanthropy in The Soul of Man Under Socialism. He noted that charitable “remedies are part of the disease... The proper aim is to try and reconstruct society on such a basis that poverty will be impossible.” He added, “Charity creates a multitude of sins. There is also this to be said. It is immoral to use private property in order to alleviate the horrible evils that result from the institution of private property. It is both immoral and unfair.”

The media spotlight on individual benefactors who control tens of billions of dollars, larger sums than many national budgets, grows in tandem with the relentless gutting of government social welfare programs. Pubic health, education and other elementary social needs are increasingly tied to the personal vicissitudes of a speculator, asset-stripper or high-tech ‘wizard.’ It is impossible to organize a modern, mass society on such a basis.

That the condition of masses of people should be dependent on the generosity of this handful of “plutocrats” is not something the Financial Times criticizes, but rather holds up as a model.

The Financial Times is not alone in its anxiety about the public response to the accumulation of vast personal wealth. The Washington Post editorialized December 22 in support of “Just Capitalism,” remarking, “Executive overpayment running into the billions sends a terrible signal about the justice of the capitalist system.” The newspaper warned that unless executive pay and the “industry of consultants [that] exists to legitimize super-sized executive pay” are reined in, “the growing material inequality in the nation will be compounded by the corrosive perception that the rules are unequal, too.”

Last week we discussed exactly why, from the point of view of the gift-countergift culture, charity reinforces the power structure: there can be no countergift by us average people when Buffet or Gates makes billions of dollars in gifts. If a gift cannot be reciprocated, subordination results. It can only create a debt which can never possibly be paid off, hence humiliation and servitude.

We also discussed the primitivist movement and wondered if going backwards is the best we can do. Kevin the Cryptogon blogger has this to say about primitivists and the green capitalist movement:

All Electric Vehicles and the Concept of EnoughAre things as bad as that? Are we that bad? Or is it a they? In other words, when you realize that much of the problem comes from a relatively small (6%?) group of humans who are not fully human, who don’t have consciences and have no possibility of developing them, the seemingly insoluble problems may actually have solutions.

December 28th, 2006

The all electric SUV is almost here! While it’s not quite the electric Hummer I wrote about recently, what did I tell ya!?!

Head down to the clean, green Walmart to buy some blood soaked crap made by slaves in China with your somehow fungible U.S. dollars. Haul your goods back to your no-money-down, stucco box (”bought” with a 50 year adjustable rate mortgage) in your new, all electric, zero emission SUV! Water your lawn. Enjoy a handful of genetically engineered peanuts as you BBQ a big, juicy clone burger. Live it up! Because it’s back to work on Monday morning.

How much more absurd can this thing get?

While the energy situation we’re facing is serious, it’s inconsequential when compared to the dire anthropological and spiritual shortcomings we humans continue to bump up against. We’re essentially feces flinging apes that somehow acquired the ability to create and use written languages and abstract computational techniques.

We have used these traits to systematically murder the Earth and enslave each other to the extent possible.

Don’t take this personally. I’m not saying that you are a planet killing fascist. But look at what has tended to happen when more than a few dozen people get together and it’s just not too pretty.

Yes, I know about the anti civilization movement, and I don’t see anything worth emulating there. I’m living more of primitive, lower energy existence than any of the people writing about anti civilization issues! This gives me quite a bit of pause about that area of inquiry. Besides, why stop at stone age tribes? Stone age tribes (the few non-violent ones, of course, not the head hunters, etc.) seem to be the nirvana state of being that these people like to write about, in front of their computers, in their heated homes. Why not crawl around on all fours? Why not partially blind ourselves to reduce our visual capability to that of a paramecium, with its light-sensing eyespot? If it’s all about going backwards, totally, and without question, why not really go for it!?

HA.

I don’t know why some of us have a concept of enough while most of us don’t. As the never-enoughers ruin the world, reactionary belief systems grow in popularity and seem increasingly valid, even though they are just as stupid as the more-forever paradigm.

Humans are great at extremism, but not so great at seeing the big picture, and carefully choosing and using appropriate tools to create stable systems that are in balance with the environment. While it’s theoretically possible to create stable systems that don’t wreck the planet, like lots of things on paper, it doesn’t happen in the real world. Why?

The tragedy of the commons is still the best explanation of why humans have failed—and will continue to fail—to create stable systems that are in balance with the environment. Even if some of us, or many of us, create such systems, hierarchical dominators will eventually build armies, bribe, swindle, deceive and kill us to exploit the stable systems we worked so hard to maintain. The enoughers have never been able to defend themselves from the notenoughers because the enoughers do not resort to extermination to achieve their goals. The notenoughers would rather see a resource destroyed than loose control of it.

The side that is better at extermination/exploitation will gain control, gain influence, and if unchecked by a different hierarchical dominator, this process will continue until some higher plateau is reached. Decline and disintegration follows in the years or decades after the plateau. Warlords will rise from the smoldering ruins, climb the mountains of skulls and do it all over again.

So here we are, having never really developed the consciousness necessary to wield the tools—that our large brains enabled us to construct—in any good way, raping the commons to within an inch of its life. Instead of flinging feces, crushing skulls with clubs, lighting off cannons or shooting machine guns, the creatures are now armed with nuclear weapons. Same ape consciousness as ever, but with the power to exterminate with god-like efficiency.

So, while the clean, green fascists jump up and down and cheer the arrival of the all electric SUV, I’ll count each day that passes without the appearance of mushroom clouds as a precious gift to those of us who understood the concept of enough.

3 Comments:

This comment has been removed by the author.

Great post.

pokevision.site

pokevision alternatives 2017

Best instapots 2018

Top 5 instapots to buy in 2018

Instant pot reviews 2018

Post a Comment

<< Home