Signs of the Economic Apocalypse, 12-31-07

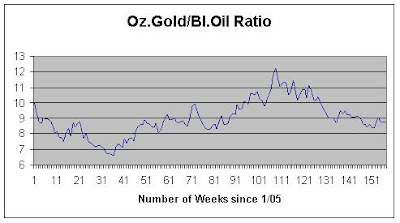

Gold closed at 842.70 dollars an ounce Friday, up 3.3% from $815.40 for the week. The dollar closed at 0.6795 euros Friday, down 2.3% from 0.6954 at the close of the previous week. That put the euro at 1.4716 dollars compared to 1.4380 the Friday before. Gold in euros would be 572.64 euros an ounce Friday, up 1.0% from 567.04 at the close of the previous Friday. Oil closed at 96.16 dollars a barrel Friday, up 3.1% from $93.31 for the week. Oil in euros would be 65.34 euros a barrel, up 0.7% from 64.89 at the close of the Friday before. The gold/oil ratio closed at 8.76 up 0.2% from 8.74 at the close of the previous week. In U.S. stocks, the Dow Jones Industrial Average closed at 13,365.87 Friday, down 0.6% from 13,450.65 the week before. The NASDAQ closed at 2,674.46 Friday, down 0.7% from 2,691.99 for the week. In U.S. interest rates, the yield on the ten-year U.S. Treasury note closed at 4.07 Friday, down ten basis points from 4.17 for the week.

Even though today is the last day of 2007, let’s take last week as the last week of the year and look at the quarterly and annual numbers. Gold rose 12.4% from $750.00 for the quarter and 31.9% from $638.80 for the year. The dollar fell 3.1% from 0.7009 for the quarter and 11.5% from 0.7576 for the year. The euro rose from 1.4267 for the quarter and from 1.3200 for the year. Gold in euros rose 8.9% from 525.69 for the quarter and 18.3% from 483.94 for the year. Oil rose 17.7% from $81.66 for the quarter and 57.5% from $61.05 for the year. Oil in euros rose 14.2% from 57.23 and 41.3% from 46.25 for the year. The gold/oil ratio fell 4.8% from 9.18 for the quarter and 19.4% from 10.46. In the U.S. stock market the Dow fell 5.2% from 14,066.01 for the quarter and rose 7.2% from 12,463.15 for the year. The NASDAQ fell 4.0% from 2,780.32 for the quarter and rose 10.7% from 2,415.29 for the year. The yield on the ten-year U.S. Treasury note fell 15.0% from 4.68 for the quarter and 15.5% from 4.70 for the year.

Here are some charts:

The most striking change of the past year in the markets is the sharp rise in gold (32%) and oil prices (57.5%) and the 11.5% drop in the value of the dollar against the euro. The past year also saw the end of economic optimism in the media as the housing bubble finally burst. The consequences of the collapse in housing prices have not fully played out. The aftershocks in the credit system will likely shape the economy in 2008. Looking ahead, it looks likely that 2008 will differ from 2007 far more significantly than 2007 differed from 2006.

The most striking change of the past year in the markets is the sharp rise in gold (32%) and oil prices (57.5%) and the 11.5% drop in the value of the dollar against the euro. The past year also saw the end of economic optimism in the media as the housing bubble finally burst. The consequences of the collapse in housing prices have not fully played out. The aftershocks in the credit system will likely shape the economy in 2008. Looking ahead, it looks likely that 2008 will differ from 2007 far more significantly than 2007 differed from 2006.Elite management of the economy has deteriorated so much in the past year that the political scene in the United States seems to be in a process of creative disintegration with the appearance of more than one grass-roots populist movement cutting across traditional ideological lines. The first was a constitutionalist, nativist movement surrounding the presidential candidacy of Ron Paul. The second is an evangelical, economic-populist movement following the candidacy of Mike Huckabee. Ron Paul’s campaign has drawn much support from the libertarian right and left because of it’s emphasis on the Bill of Rights and a dismantling of the U.S. Empire. Mike Huckabee’s campaign has sliced the Republican coalition down the middle by running and anti-corporate, anti-economic elite campaign appealing to religious conservatives. Both candidates seem to have disturbed the elite and both have had some of there more divisive proposals brought forward by the mainstream, corporate media to blunt their momentum.

Huckabee's Rise Drives Wedge Between Wall Street, Evangelicals

Matthew Benjamin

Dec. 27 (Bloomberg) -- Wealthy Republicans have a new political nightmare that may be scarier than Hillary Clinton: Mike Huckabee.

The former Arkansas governor has surged in Republican presidential-preference polls, winning the support of Christian fundamentalists while peppering his campaign rhetoric with jabs at the financial industry. He calls himself the candidate who isn't a “wholly owned subsidiary” of investment banks, decries large executive-pay packages and says the party needs to shift its focus from Wall Street to Main Street.

In doing so, he threatens the uneasy if effective coalition Republicans have counted on for three decades: abortion opponents and other social-issue activists supplying foot soldiers, proponents of tax cuts and business-friendly regulatory policies putting up the money and getting the biggest economic benefits.

“Huckabee puts this long-simmering feud between the social-conservative wing and the country-club and business crowd into starker contrast,” said Stuart Rothenberg, publisher of the nonpartisan Rothenberg Political Report in Washington.

Polls show Huckabee, 52, leading in the first Republican electoral contest, the Jan. 3 Iowa caucuses. In national polls, he is within striking distance of former New York Mayor Rudy Giuliani.

Backlash

The stronger he gets in the polls, the stronger the intra- party backlash against him. “He's sort of a populist, and that doesn't sell too well on Wall Street,” said David Hedley, a retired managing director at Donaldson Lufkin & Jenrette who raised at least $100,000 for George W. Bush in the 2000 presidential election.

The Club for Growth, a Washington-based group that advocates tax and spending cuts, has mounted a campaign against Huckabee in Iowa and South Carolina, which holds its Republican primary on Jan. 19. The group said Dec. 14 it is doubling advertising purchases and urged taxpayers to call Huckabee and challenge him on his tax policy.

The group says Huckabee's tax increases while governor from 1996 to 2007 far surpassed reductions, with the average tax burden for state residents increasing 47 percent during his tenure.

“Mike Huckabee is not an economic conservative,” said Pat Toomey, a former Pennsylvania congressman and the club's president. “He's the only Republican in the field who really is truly a big-government liberal.”

‘Huckacide’

The Wall Street Journal editorial page has repeatedly attacked Huckabee in recent weeks, and the National Review magazine warned Republicans against committing “Huckacide.”

“These guys don't like Huckabee because he's not one of them,” said Ed Rollins, the Huckabee campaign chairman. “They have enjoyed the reins of power a long time, and he's a threat.”

Rollins, who ran Ronald Reagan's re-election campaign in 1984, recalls that some economic conservatives were initially suspicious of him too: “Ronald Reagan wasn't one of them, and he also had raised taxes to fix problems.”

After Huckabee finished second in an August Iowa straw poll, he said in an interview that his biggest asset going into the contest “was the negative attack ads that the Club for Greed, excuse me, the Club for Growth was running.”

‘Extraordinary Disconnect’

Huckabee said he represents Republican voters who feel estranged from the party. “There's an extraordinary disconnect between people who have sort of had a traditional leadership role in the Republican Party and the folks on Main Street,” he said. “There's a difference between Wall Street Republicans and Main Street Republicans.”

For the moment, the shots at Wall Street are helping Huckabee among Republican voters, said Costas Panagopolous, director of the Center for Electoral Politics and Democracy at Fordham University in New York. “In rural America and most of the country, Wall Street is a big, bad bogeyman, and he's tapping into this perception.”

Chuck Hurley, president of the Iowa Family Policy Center, a nonprofit pro-family organization in Des Moines, said that “it wouldn't surprise me that there's some antipathy for the Goldman Sachs bonuses among rank-and-file stockholders in rural Iowa.” Hurley has endorsed Huckabee, though his organization remains neutral…

Martin Wolf is the chief economist of the Financial Times and a wonderful journalist. In his work: at international conferences, and over a thousand dinner tables and at countless coffee sessions, he comes into daily contact with some of the most wealthy and powerful men and women in the world and those that serve them. Wolf hears them speak and most of all picks up their body language, their silences and vibrations. His article on "limits", which I am quoting abundantly is the cri de coeur of a man who, though not wealthy and powerful himself, knows the ways of the wealthy and powerful as no other does...

If we examine what Martin Wolf is saying logically, not even really reading between the lines, this supremely informed man is declaring that he knows that, before they ever pay Scandinavian like income taxes, drive small cars and wear sweaters around the house on cold winter days, the elites of the United States will create a police state and go to war endlessly to dominate the resource rich areas of the world. Hyperbole? Examine George W. Bush's presidency in that light and perhaps Dubya may not really be as dumb as he looks.. Or maybe he is more like what May West said about Ronald Reagan, "dumb but willing."At this juncture, the elites of the Republican Party begin to separate from the middle class and working class base and the only way to keep them on board would be endless war and endless fear. Terror and paranoia may be the key to 2008 election. What moldy old Marxists used to call, "false consciousness". The Republican Party, to use another worn but useful Marxist term, has entered into contradiction with itself and using Wolf's analysis as our text, is clearly going to tear itself apart…

It is a timeworn, but evergreen cliché, that keeping working class white people from realizing how much they have in common with working class black people is one of the secrets of American capitalism's stunning success... And Huckabee is playing with that. He is against tax breaks for the rich, he attacks Bush's "arrogance". The Cato Institute gave him an "F" as governor of Arkansas, because of his taxing and spending on education and he calls the ultraconservative political action committee, "Club for Growth" the "Club for Greed". He even makes positive noises about the environment.

What is Huckabee after?

My reading is that he wants to take control of the political and social juice of the American Evangelical movement and that includes the black Evangelicals too... The mind boggles.

It should be remembered that Southern Evangelical Protestantism is resentful and anti-elitist before it is anything else. It is against any "expert" opinion. They feel that these "experts" look down on them with contempt and they are probably right...

Both poor white people and poor black people face this kind of contempt all their lives. The Evangelicals love for creationism and the literal reading of scripture is because the Bible trumps the "experts"... any hick quoting the good book is superior to a PhD from MIT quoting Darwin. The same psychology holds true for "Rapture" enthusiasts, they will be saved, taken directly up to heaven and all the people who have ever treated them so shabbily here on earth will suffer indescribable torment and humiliation, which the chosen will be able to watch from heaven. It is interesting to note that Tim LaHaye the author of the "Left Behind" series has enthusiastically endorsed Huckabee. This has all the signs of being a "movement", not just another primary campaign.I titled this post, "Huckabee tickles my inner Lenin" and what I mean is this:

The entire American economy is based on making people feel bad about themselves, making them feel poor, ugly, sick, helpless, stupid, inadequate and then offering to sell them something to relieve the pain of rejection and failure. What, despite all its grotesque fanaticism, is truly healthy about all this Evangelical, rapture, mishegoss is that it is a real rebellion against the basic, inhuman tool of the system... Its unhappiness factory.

The solution won’t come from the normal political process. The corporate elite publish the polls, count the votes, and report on the elections. They have proven that they will steal the vote if they have to. The elite wasn’t very happy with Franklin Roosevelt during the last depression and it doesn’t look like they want another one this time. It may be that they may now think that fascism was premature in the 1930s, that the technology was not sufficiently developed.

If the mainstream media now acknowledges the probability of a recession in 2008, you can bet that an actual depression is much more likely than anyone is willing to let on. In the 1930s the rural areas were the hardest hit. Now it may be the suburbs:

Tent city in suburbs is cost of U.S. home crisis

Dana Ford

Friday December 21 2007

ONTARIO, Calif., Dec 21 (Reuters) - Between railroad tracks and beneath the roar of departing planes sits "tent city," a terminus for homeless people. It is not, as might be expected, in a blighted city center, but in the once-booming suburbia of Southern California.

The noisy, dusty camp sprang up in July with 20 residents and now numbers 200 people, including several children, growing as this region east of Los Angeles has been hit by the U.S. housing crisis.

The unraveling of the region known as the Inland Empire reads like a 21st century version of "The Grapes of Wrath," John Steinbeck's novel about families driven from their lands by the Great Depression.

As more families throw in the towel and head to foreclosure here and across the nation, the social costs of collapse are adding up in the form of higher rates of homelessness, crime and even disease.

While no current residents claim to be victims of foreclosure, all agree that tent city is a symptom of the wider economic downturn. And it's just a matter of time before foreclosed families end up at tent city, local housing experts say.

"They don't hit the streets immediately," said activist Jane Mercer. Most families can find transitional housing in a motel or with friends before turning to charity or the streets. "They only hit tent city when they really bottom out."

Steve, 50, who declined to give his last name, moved to tent city four months ago. He gets social security payments, but cannot work and said rents are too high.

"House prices are going down, but the rentals are sky-high," said Steve. "If it wasn't for here, I wouldn't have a place to go."

'Squatting In Vacant Houses'

Nationally, foreclosures are at an all-time high. Filings are up nearly 100 percent from a year ago, according to the data firm RealtyTrac. Officials say that as many as half a million people could lose their homes as adjustable mortgage rates rise over the next two years.

California ranks second in the nation for foreclosure filings -- one per 88 households last quarter. Within California, San Bernardino county in the Inland Empire is worse -- one filing for every 43 households, according to RealtyTrac.

Maryanne Hernandez bought her dream house in San Bernardino in 2003 and now risks losing it after falling four months behind on mortgage payments.

"It's not just us. It's all over," said Hernandez, who lives in a neighborhood where most families are struggling to meet payments and many have lost their homes.

She has noticed an increase in crime since the foreclosures started. Her house was robbed, her kids' bikes were stolen and she worries about what type of message empty houses send.

The pattern is cropping up in communities across the country, like Cleveland, Ohio, where Mark Wiseman, director of the Cuyahoga County Foreclosure Prevention Program, said there are entire blocks of homes in Cleveland where 60 or 70 percent of houses are boarded up.

"I don't think there are enough police to go after criminals holed up in those houses, squatting or doing drug deals or whatever," Wiseman said.

"And it's not just a problem of a neighborhood filled with people squatting in the vacant houses, it's the people left behind, who have to worry about people taking siding off your home or breaking into your house while you're sleeping."

Health risks are also on the rise. All those empty swimming pools in California's Inland Empire have become breeding grounds for mosquitoes, which can transmit the sometimes deadly West Nile virus, Riverside County officials say.

'Trickle-Down Effect'

But it is not just homeowners who are hit by the foreclosure wave. People who rent now find themselves in a tighter, more expensive market as demand rises from families who lost homes, said Jean Beil, senior vice president for programs and services at Catholic Charities USA.

"Folks who would have been in a house before are now in an apartment and folks that would have been in an apartment, now can't afford it," said Beil. "It has a trickle-down effect."

For cities, foreclosures can trigger a range of short-term costs, like added policing, inspection and code enforcement. These expenses can be significant, said Lt. Scott Patterson with the San Bernardino Police Department, but the larger concern is that vacant properties lower home values and in the long-run, decrease tax revenues.

And it all comes at a time when municipalities are ill-equipped to respond. High foreclosure rates and declining home values are sapping property tax revenues, a key source of local funding to tackle such problems.

Earlier this month, U.S. President George W. Bush rolled out a plan to slow foreclosures by freezing the interest rates on some loans. But for many in these parts, the intervention is too little and too late.

Ken Sawa, CEO of Catholic Charities in San Bernardino and Riverside counties, said his organization is overwhelmed and ill-equipped to handle the volume of people seeking help.

"We feel helpless," said Sawa. "Obviously, it's a local problem because it's in our backyard, but the solution is not local."

Labels: credit crunch, Economic depression 2008, housing crisis