Signs of the Economic Apocalypse, 9-8-08

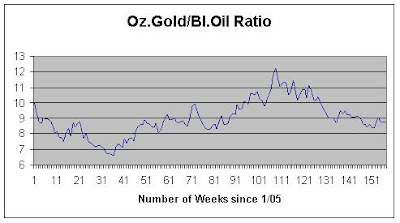

Gold closed at 802.80 dollars an ounce Friday, down 4.1% from $835.20 for the week. The dollar closed at 0.7009 euros Friday, up 2.8% from 0.6815 at the close of the previous week. That put the euro at 1.4267 dollars compared to 1.4674 the week before. Gold in euros would be 562.70 euros an ounce, down 1.1% from 569.17 at the close of the previous Friday. Oil closed at 106.23 dollars a barrel Friday, down 8.7% from $115.46 at the end of the week before. Oil in euros would be 74.46 euros a barrel, down 5.7% from 78.68 for the week. The gold/oil ratio closed at 7.56, up 4.6% from 7.23 at the end of the week before. In U.S. stocks, the Dow closed at 11,220.96 Friday, down 2.9% from 11,543.55 at the close of the previous Friday. The NASDAQ closed at 2,255.88 Friday, down 4.9% from 2,367.52 at the close of the week before. In U.S. interest rates, the yield on the ten-year U.S. Treasury note closed at 3.70%, down 11 basis points from 3.81 for the week.

Signs of an economic collapse began to pile up again last week, leading to further drops in commodity prices. Oil fell almost 9% and gold fell 4%. The dollar continued to rise against the euro. Job losses continued in the United States and now 9% of houses in the U.S. are behind in payments or in foreclosure. Finally, the U.S. government seized Fannie Mae and Freddie Mac.

US jobless rate soars as foreclosures break new record

Bill Van Auken6 September 2008

In a stark indication that the crises gripping the US housing market and the financial sector are spreading throughout the economy, unemployment figures for August rose far more sharply than expected, hitting a five-year high.

The official unemployment rate rose to 6.1 percent last month, according to a report released Friday by the Bureau of Labor Statistics. In addition to the net loss of 84,000 jobs last month, the agency revised its figures for June and July, reporting the destruction of an additional 58,000 jobs, pointing to an entire summer dominated by layoffs and economic slump.

Meanwhile the so-called misery index, which adds the unemployment and inflation rates, hit 11.7 percent, the worst figure recorded since mid-1991, as high gas, food and utility prices continue to gouge workers’ paychecks even as layoffs mount.

Also on Friday, the Mortgage Bankers Association issued a report showing that the new foreclosure rate has risen to its highest point in nearly three decades, as falling home prices and tighter credit is forcing more and more people out of their homes. The total number of homes in foreclosure hit 2.75 percent, triple the rate recorded three years ago. Meanwhile, 6.41 percent of all home mortgages were one or more payments overdue, a record high since these figures were first recorded in 1979.

At the same time, existing home sales fell to a 10-year low in the second quarter, while the median price of a single-family house plummeted by another 7.6 percent, the National Association of Realtors reported.

The increase in unemployment and the rising number of foreclosures are clearly trends that are feeding into one another in a vicious downward spiral. Workers having lost their jobs are finding it impossible to meet monthly mortgage payments, and the collapse of home values has wiped out credit for many, leading to falling consumption and new layoffs.

The loss of jobs was spread throughout the economy, with health care, education and government employment virtually alone in resisting the surge of layoffs. Manufacturing companies cut 61,000 workers from their payrolls; business and professional companies eliminated 53,000 jobs, temporary employment—which generally is a leading indicator of future job trends—fell by 36,000 and the retail trade sector cut 19,900 jobs. Construction employment was down just 8,000, reflecting in part the massive bloodletting that has already taken place—558,000 jobs wiped out since the beginning of 2007.

Massive new layoffs are on the horizon. The Air Transport Association reported Friday that US airlines plan to cut at least 36,000 jobs by the end of the year.

Job cuts will continue throughout the auto industry as new vehicle sales slump. The DMAX engine plant in Dayton, Ohio announced this week that it is laying off another 330 workers, on top of 290 jobs cut in July. The plant makes engines for GM trucks. Daimler Trucks North America, meanwhile, has announced plans to cut one of the two shifts at its Mount Holly, North Carolina Freightliner plant, putting 675 workers on the unemployment lines.

The financial sector is also shedding large numbers of jobs. GMAC Financial Services announced this week it will lay off 5,000 workers, while Wachovia Corp. has indicated that it intends to eliminate the jobs of some 7,000 of its employees.

The official figures released Friday were substantially higher than those predicted by economists, who had projected only a 0.1 percent increase over July’s rate of 5.7 percent, with the loss of 75,000 jobs, rather than a 0.4 jump to 6.1 percent and the loss of 84,000 jobs.

The decisive issue in the unemployment figures is the sustained character of the assault on jobs, with unemployment rising for eight months straight—the most protracted such trend in the last 25 years. The result is that 2.2 million more workers have joined the unemployment lines over the past year, for a total of 9.4 million officially counted as out of work.

These figures drastically underestimate the real crisis confronting working people in the US. An alternative measure provided by the Bureau of Labor Statistics, which includes so-called “discouraged workers”—those who have given up actively looking for work—as well as those forced to eke out a living with part-time jobs because they are unable to get full-time work, rose by a tenth of a percentage point to account for fully 10.7 percent of the US workforce.

The latest report on the growth in unemployment elicited widespread acknowledgment that the US economy is gripped by recession.

“The economy has clearly slipped into a jobs recession because the housing meltdown and credit market turmoil has spread to the broader economy,” Steven Wood, chief economist at Insight Economics, wrote after the new figures were released.

Bank of America economist Peter Kretzmer, in a note to investors, wrote, “The rapid rise in the unemployment rate points to a US recession, as such an increase has never occurred outside of one.” The economist said that household surveys have produced data indicating that 1.75 million jobs have been wiped out since April alone.

William Poole, former president of the Federal Reserve Bank of St. Louis, told Bloomberg Television, “It certainly increases the probability that we really are in a recession. It is a weak number, including the [June, July] revisions.”

Friday’s dismal unemployment and foreclosure figures came at the end of the worst week for the world financial markets since the aftermath of the terrorist attacks on New York City and Washington seven years ago.

The Dow Jones Industrial average eked out a 32-point advance Friday after falling nearly 350 points, or 3 percent, the day before—the worst losses in two months. The sell-off was attributed to the release of the initial projection of a 5.7 percent unemployment rate, combined with dismal retail sales figures and rampant rumors that a major hedge fund, Atticus Capital, with $14 billion in investments, was on the brink of collapse.

While the Atticus executives insisted that the rumors were false and that the fund had substantial cash reserves, the fears that major hedge funds will go under are well founded. Many of them had invested heavily in the commodity bubble, which has been rapidly deflating with the recent fall in oil and food prices.

Asian stock markets, which fell every day this week, suffered sharp losses Friday, with the Hang Seng index in Hong Kong falling 2.2 percent, Tokyo’s Nikei down 2.75 percent, the Shanghai A-share market dropping 3.3 percent and Australia’s market down 2.1 percent. Similar percentage losses were recorded on all of the major European markets.

Meanwhile, the manager of the world’s largest bond fund warned Friday that the US economy faced a “financial tsunami” unless the government intervenes to buy up assets being dumped by banks and finance houses.

“Unchecked, it can turn a campfire into a forest fire, a mild asset bear market into a destructive financial tsunami,” Bill Gross of California-based Pacific Investment Management Co. wrote in a statement on the company’s web site. “If we are to prevent a continuing asset and debt liquidation of near historic proportions, we will require policies that open up the balance sheet of the US Treasury.” Specifically, he called for the federal government to stem the foreclosure tide by issuing subsidized loans and buying up properties.

Gross’s statement reflects growing fears within financial circles that the worst of the credit crisis is still to come and could produce a catastrophic global collapse.

In the face of the rapidly deepening economic crisis, the White House issued a sanguine statement that simply ignored the job losses and rise in foreclosures, pointing instead to earlier figures showing an increase in the gross domestic product. “The level of growth demonstrates the resilience of the economy in the face of high energy prices, a weak housing market and difficulties in the financial markets,” the White House said.

While this is obviously cold comfort to the millions forced onto the unemployment lines or facing the loss of their homes, the attempt by the candidates of the two major parties to turn the latest figures into political hay offered little more.

Republican candidate John McCain acknowledged that “Americans are hurting and we must act to create jobs.” He vowed to enact a “Jobs for America” program, which appeared to involve little more than job training schemes, tax cuts for business and advocacy of free trade.

Democratic candidate Barack Obama issued a predictable statement accusing his rival McCain of preparing “more of the same” and continuing the Bush administration’s tax cuts for the rich. He pledged instead to institute an exceedingly modest tax cut for “middle-class families” plus a $50 billion fund to aid state budgets.

There is no reason to believe such paltry promises will be realized. Even they were, they would prove entirely inadequate to stem the tide of layoffs or stabilize the crisis-ridden financial system. The Democratic Party is incapable of advancing any serious alternative to the policies of the Bush administration, tied as it is to the interests of Wall Street and corporate America.

The continuing housing crisis led the U.S. government to take over the two Government Sponsored Enterprises, Fannie Mae and Freddie Mac in order to prevent a collapse of the world financial system.

Officials announce takeover of mortgage giants

September 7, 2008

Alan Zibel and Martin Crutsinger

WASHINGTON (AP) -- The Bush administration, acting to avert the potential for major financial turmoil, announced Sunday that the federal government was taking control of mortgage giants Fannie Mae and Freddie Mac.

Officials announced that the executives and board of directors of both institutions had been replaced. Herb Allison, a former vice chairman of Merrill Lynch, was selected to head Fannie Mae, and David Moffett, a former vice chairman of US Bancorp, was picked to head Freddie Mac.

Treasury Secretary Henry Paulson says the historic actions were being taken because "Fannie Mae and Freddie Mac are so large and so interwoven in our financial system that a failure of either of them would cause great turmoil in our financial markets here at home and around the globe."

The huge potential liabilities facing each company, as a result of soaring mortgage defaults, could cost taxpayers tens of billions of dollars, but Paulson stressed that the financial impacts if the two companies had been allowed to fail would be far more serious.

"A failure would affect the ability of Americans to get home loans, auto loans and other consumer credit and business finance," Paulson said.

Both companies were placed into a government conservatorship that will be run by the Federal Housing Finance Agency, the new agency created by Congress this summer to regulate Fannie and Freddie.

The Federal Reserve and other federal banking regulators said in a joint statement Sunday that "a limited number of smaller institutions" have significant holdings of common or preferred stock shares in Fannie and Freddie, and that regulators were "prepared to work with these institutions to develop capital-restoration plans."

The two companies had nearly $36 billion in preferred shares outstanding as of June 30, according to filings with the Securities and Exchange Commission.

Paulson said that it would be up to Congress and the next president to figure out the two companies' ultimate structure.

"There is a consensus today ... that they cannot continue in their current form," he said.

Paulson and James Lockhart, director of the Federal Housing Finance Agency, stressed that their actions were designed to strengthen the role of the two mortgage giants in supporting the nation's housing market. Both companies do that by buying mortgage loans from banks and packaging those loans into securities that they either hold or sell to U.S. and foreign investors.

The companies own or guarantee about $5 trillion in home loans, about half the nation's total.

Lockhart said that both Fannie and Freddie would be allowed to increase the size of their holdings of mortgage-backed securities to bolster the housing industry as it undergoes its worst downturn in decades.

Lockhart said in order to conserve about $2 billion in capital the dividend payments on both common and preferred stock would be eliminated. He said that all lobbying activities of both companies would stop immediately. Both companies over the years made extensive efforts to lobby members of Congress in an effort to keep the benefits they enjoyed as government-sponsored enterprises.

Both Paulson and Lockhart were careful not to blame Daniel Mudd, the CEO of Fannie Mae, or Freddie Mac CEO Richard Syron for the companies' current problems. While both men are being removed as the top executives, they have been asked to remain for an unspecified period to help with the transition.

The problem is that each time they do something like this, the obligations of the already vastly overstretched U.S. government increase. In this takeover plan the U.S. Treasury will purchase mortgage securities.

U.S. Rescue Seen at Hand for 2 Mortgage Giants

Stephen Labaton and Andrew Ross Sorkin

September 6, 2008

WASHINGTON — Senior officials from the Bush administration and the Federal Reserve on Friday called in top executives of Fannie Mae and Freddie Mac, the mortgage finance giants, and told them that the government was preparing to place the two companies under federal control, officials and company executives briefed on the discussions said.

The plan, which would place the companies into a conservatorship, was outlined in separate meetings with the chief executives at the office of the companies’ new regulator. The executives were told that, under the plan, they and their boards would be replaced and shareholders would be virtually wiped out, but that the companies would be able to continue functioning with the government generally standing behind their debt, people briefed on the discussions said.

It is not possible to calculate the cost of any government bailout, but the huge potential liabilities of the companies could cost taxpayers tens of billions of dollars and make any rescue among the largest in the nation’s history.

The drastic effort follows the bailout this year of Bear Stearns, the investment bank, as government officials continue to grapple with how to stem the credit crisis and housing crisis that have hobbled the economy. With Bear Stearns, the government provided guarantees, and the bulk of its assets were transferred to JPMorgan Chase, leaving shareholders with a nominal amount.

Under a conservatorship, the common and preferred shares of Fannie and Freddie would be reduced to little or nothing, and any losses on mortgages they own or guarantee could be paid by taxpayers. Shareholders have already lost billions of dollars as the stocks have plunged more than 80 percent this year.

…The declines in the housing and financial markets apparently forced the administration’s hand. With foreign governments increasingly skittish about holding billions of dollars in securities issued by the companies, no sign that their losses will abate any time soon, and the inability of the companies to raise new capital, the administration apparently decided it would be better to act now rather than closer to the presidential election in two months.

Just five weeks ago, President Bush signed a law to give the administration the authority to inject billions of dollars into the companies through investments or loans. In proposing the legislation, Treasury Secretary Henry M. Paulson Jr. said that he had no plan to provide loans or investments, and that merely giving the government the authority to backstop the companies would provide a strong shot of confidence to the markets. But the thin capital reserves that have kept the two companies afloat have continued to erode as the housing market has steadily declined and the number of foreclosures has soared.

As their problems have deepened — and the marketplace has come to expect some sort of government rescue — both companies have found it difficult to raise new capital to absorb future losses. In recent weeks, Mr. Paulson has been reaching out to foreign governments that hold billions of dollars of Fannie and Freddie securities to reassure them that the United States stands behind the companies.

In issuing their quarterly financial statements last month, the two companies reported huge losses and predicted that home prices would fall more than previously projected.

The debt securities the companies issue to finance their operations are widely owned by mutual funds, pension funds, foreign governments and big companies…

The meetings reflected the reality that senior administration officials did not believe they could wait for some kind of financial tipping point, as happened with Bear Stearns, which was saved from insolvency in March by government intervention after its stock plummeted and lenders withheld their capital.

Instead, Mr. Paulson has struggled to navigate through potentially conflicting goals — stabilizing the financial markets, making mortgages more widely available in a tightening credit environment, and protecting taxpayers from possibly enormous losses…

It appears likely that Paulson’s ship will hit all three rocks. He can only stabilize the financial markets for so long. Who will to buy houses when values plummet and jobs are cut? And, the costs of all the bailouts will paid by taxpayers.

Labels: Fannie Mae, Freddie Mac, housing crisis, unemployment