Signs of the Economic Apocalypse, 7-3-06

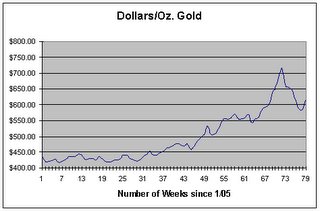

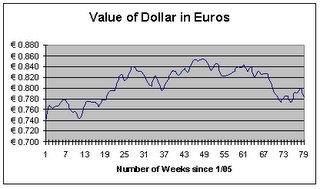

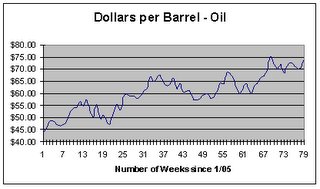

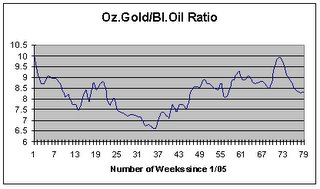

Gold closed at 616.20 dollars an ounce on Friday, up 5.2% from $586.00 for the week. The dollar closed at 0.7819 euros on Friday, down 2.3% from 0.7996 at the close of the previous week. The euro, then, closed at 1.2790 dollars compared to 1.2507 at the end of the week before. Gold in euros would be 481.78 euros an ounce, up 3.9% from 463.61 at the previous week’s close. Oil closed at 73.85 dollars a barrel Friday, up 4.2% from $70.84 for the week. Oil in euros would be 57.74 dollars a barrel, up 1.9% compared to 56.64 the Friday before. The gold/oil ratio closed at 8.34, up 0.8% from 8.27 for the week. In the U.S. stock market, the Dow closed at 11,150.22 up 1.5% from 10,989.09 at the close of the previous week. The NASDAQ closed at 2,172.09, up 2.4% from 2,121.47 for the week. In U.S. interest rates the yield on the ten-year U.S. Treasury note closed at 5.14%, down eight basis points from 5.22 at the end of the previous Friday.

Friday was the end of the second quarter, so let’s look at the numbers for 2006 so far.

The price of gold in dollars went from $583.50 to $616.20 in the second quarter, an increase of 5.6%. For the year, gold went from $519.70 to $616.20, an increase of 18.6%.

Gold in euros was virtually unchanged in the second quarter, rising from 481.52 an ounce to 481.78. For the year gold priced in euros went from 438.60 to 481.78, a rise of 9.8%.

The dollar went from 0.8252 euros to 0.7819 euros in the second quarter, a drop of 5.5%. For the year, the dollar went from 0.8440 euros to 0.7819, a drop of 7.9%. The euro went from 1.1849 dollars to $1.2790 for the year and from 1.2118 for the quarter.

The price of oil in dollars went from 66.35 to 73.85 dollars a barrel in the second quarter, a rise of 11.3%. For the year, oil went from $61.04 to $73.85, a rise of 21.0%.

Oil in euros went from 54.75 euros a barrel to 57.74 for the quarter, a rise of 5.5%. For the year oil went from 51.43 euros a barrel to 57.74, a rise of 12.3%.

The gold/oil ratio went from 8.79 to 8.34 for the quarter (meaning the price of oil rose faster than the price of gold) a drop of 5.4%.

The Dow Jones Industrial Average went from 11,109.32 to 11,150.22 for the quarter, a rise of 0.4%. For the year it went from 10,717.50 to 11,150.22, a rise of 4.0%. The NASDAQ went from 2,339.79 to 2,172.09 for the quarter, a drop of 7.7%. For the year, it went from 2,205.32 to 2,172.09, a drop of 1.5%.

The yield on the ten-year U.S. Treasury note went from 4.85% to 5.14% in the second quarter, a rise of 29 basis points. For the year it went from 4.39 to 5.14, a rise of 75 basis points.

Looking at the year so far, a few things stand out. The price of oil has risen steadily. Gold has risen as well but not as steadily, given the recent correction which seems to have found a bottom in the mid-$580s. The dollar has been able to maintain its value, due in large part to rising short term interest rates by the U.S. Federal Reserve Board. As we will see, that may not last much longer.

So far no crash. That’s the good news. They have managed to keep the system afloat for another six months-- not a bad accomplishment. One might even be tempted to think “they” know what they are doing. Nick Beams, discussing the annual report of the Bank of International Settlements, argues that they don’t:

Bankers’ bank puzzles over state of world economy

By Nick Beams

30 June 2006

Recently in an email to the WSWS a reader drew a contrast between what she called the “explosive situation” in China—an “unregulated economy within a dictatorship”—and the United States where the economy is “regulated, open and handled by the best business-brains available.”

While not often stated so baldly, the views expressed here are quite widely held; that while there may be problems in what could be called the extremities of the world economy, the heart is basically sound and functions under the watchful eye of central bankers and financial regulators ready to intervene if necessary.

Anyone who subscribes to such a view would do well to examine the annual report of the Bank for International Settlements (BIS) published this week. Set up in the late 1920s to organise World War I reparations payments from Germany, the BIS is a unique body in the world of finance. Not tied to any particular national banking authority and functioning as a kind of “central bankers’ bank”, it often provides analyses of the world economy not found elsewhere.

The main press commentary on this year’s BIS report has focused on remarks by general manager Malcolm Knight that interest rates will have to be further tightened. “It would be imprudent,” he said, “to count on the happy combination of strong growth and low inflation lasting indefinitely. At some point, central banks may have to act more forcefully on policy rates than they have in the past few years.”

One of the report’s central themes was that while the recent period of low inflation resulting from globalisation has been beneficial, the low interest rate regime that has followed may have created other problems in the form of asset price inflation and global trade imbalances.

These problems are dealt with in some detail in the conclusion to the report. It makes clear that far from financial markets operating under the regulation of the “best brains”, they are wracked by a series of contradictions which central bankers do not really understand, much less know how to control.

For example, the report notes that the compression of interest rates between more secure and riskier assets “remains a puzzle”, the surge in equity and housing prices globally “seems hard to reconcile with wide differences in domestic growth prospects” and that the “explosion in merger and acquisition activity, particularly in Europe, also seems difficult to rationalise.”

Like many other financial institutions, the BIS insists that the present global imbalances, above all the growing US current account deficit and the continued accumulation of foreign currency reserves by China and the East Asian economies, are not sustainable in the long run. However, “given the complexity of the situation and the limits of our knowledge, it is extremely difficult to predict how all this might unfold.”

One scenario is a “bang” of market turbulence. Another is the “whimper” of a long period of slow growth.

There are a number of possible triggers for a market “bang”, including: the tightening of interest rates, protectionist legislation relating to China or Middle East oil exporters, or the sudden failure of a large firm with major financial interests. But it could be something else entirely, for, as the report points out, “the triggers for most of the financial crises observed over the last few decades were almost entirely unexpected.”

One of the major problems confronting would-be regulators is the exponential expansion of financial markets in recent years, especially because of the operations of hedge funds and the ever-more widespread use of derivatives. These are contracts which by their nature involve speculation about the movement of interest rates, currency rates, share prices, debt ratings among other indices. Accordingly, there are “several market-specific reasons” for concern. “In the main industrial countries, there are many new participants in financial markets and many new financial products, of increasing complexity and opacity. Market liquidity in this new environment has yet to be put to the test.”In other words, while the use of complex derivatives is supposed to lessen financial turbulence through the spreading of risk, no one knows whether this is really the case. In fact, complex global financial connections mean that problems in one area may become amplified, rather than dampened, as trades unwind across the world. Accordingly, “there is a reasonable likelihood that if one market were to come under significant stress, it would spill over to others.”

The drop in the dollar and the rise in the price of gold last week were both attributed to the announcement by the U.S. Federal Reserve Board that it might stop raising interest rates:

Gold in New York Rises Most Since September 2001

June 30 (Bloomberg) -- Gold in New York surged the most since the Sept. 11 terrorist attacks in the U.S. after the Federal Reserve suggested it may take a break from raising interest rates, eroding the value of the dollar.

Gold jumped 4.6 percent to $616 an ounce after the Fed yesterday said more rate increases may be needed only if statistics warrant. The dollar fell against the euro on speculation the European Central Bank may raise rates faster than in the U.S. Gold is up 16 percent this year as the dollar fell 7.3 percent against the euro. Silver also gained.

Comments by the Fed are “very friendly to the gold market,” said Michael Guido, director of hedge fund marketing and commodity strategy at Societe Generale in New York. “All the sideline buyers are thinking this could be the bottom of the gold market for the year. There's a lot more confidence to adding to positions.”

Gold futures for August delivery rose $27.10 on the Comex division of the New York Mercantile Exchange. The 4.6 percent gain was the biggest since Sept. 14, 2001, the first day of trading after the terrorist attacks closed U.S. markets. The metal reached a 26-year high of $732 on May 12…

Rate Expectations

The Philadelphia Stock Exchange Gold and Silver Index of 16 companies rose, led by silver producer Coeur d'Alene Mines Corp. and Kinross Gold Corp. The index gained 2 percent to 143.57, the highest settlement since May 16.

Interest-rate futures show traders see 59 percent odds of a quarter-percentage point increase in the overnight lending rate between banks, to 5.5 percent, in August. Two days ago, the figure was 85 percent.

“The Fed's comments yesterday indicate there is going to be no more interest-rate increases and this is pushing up gold,”said Ron Schouten, a precious-metals trader at Hollandsche Bank-Unie in Amsterdam. “The stronger euro-dollar is also helping.”

Fed officials are trying to avoid a hard landing for the U.S., where higher t rates may restrain job growth and curtail spending. The Fed had increased rates for 17 straight times to curb inflation.

Inflation Pressure

U.S. consumer prices climbed at an annual rate of 5.2 percent in the five months ended May, up from 3.6 percent a year earlier. Excluding food and energy, so-called core prices rose at an annual rate of 3.1 percent, compared with a 2.4 percent gain a year earlier.

“The combination of inflation pressures and a slowdown in economic growth are positive for gold,”said Michael Widmer, an analyst at Macquarie Bank Ltd. in London. “There is limited scope for the U.S. dollar to move higher now. Some uncertainty has been removed.”

Investors buy gold as an alternative to the dollar.

“The psychology now is to sell the dollar and buy the euro and other currencies,”said Richard Franulovich, a senior currency strategist at Westpac Banking Corp. in New York.

Since April 1, the correlation between gold and euro has increased to 0.55, compared with 0.37 in the first quarter. The coefficient measures to what degree two variables move in lockstep. The dollar weakened to $1.2786 per euro at 1:17 p.m. in New York, from $1.2664 late yesterday, reaching the lowest since June 8.

European Confidence

A report today showing European confidence in the economy was the highest in five years “is fueling speculation the EU will have to speed up rate hikes in the region,”said John Licata, chief investment strategist for Blue Phoenix Inc., a precious-metals and energy firm in New York. “The dollar is under heavy pressure against the euro, which is causing a nice premium in gold prices.”

The Fed yesterday raised its overnight lending rate by a quarter-point to 5.25 percent. Some investors interpreted accompanying statements to mean the central bank may pause after nudging rates higher at each meeting for two years.

Gold as Insurance

“Gold looks more attractive,”said Zach Liggett, who helps manage $550 million in individual accounts and the Utopia Fund at Traverse City, Michigan-based Financial & Investment Management Group. “It's good to have gold as insurance in case central banks lose their nerve and slow down this tightening campaign.”

An end to the cycle of interest-rate increases by the Fed would leave the European Central Bank set to outpace its American counterpart, after ECB policy makers this week said they may quicken their pace of rate boosts.

“We've increased our investments on gold,”said Christoph Eibl, head of commodities trading at Tiberius Asset Management AG in Stuttgart, Germany. “There's dollar weakness and oil prices are strong.”

Crude oil rose for an eighth straight day, approaching $74 a barrel. Prices are up 21 percent this year.

Frightened by the prospect of a crash, it seems the Fed is reversing course. The problem they face is that the period of low interest rates we have not yet left has given the world excessive, asset bubbles, and global imbalances. Keeping interest rates low will only exacerbate those problems. Here’s Michael Shedlock on the continued expansion of credit:

Musical Chairs

I was recently asked if I saw anything whatsoever that suggested lenders are tightening at all in the face of declining collateral and rising debt service pressures on their customers.The answer to that question is a resounding no. In fact the latest data shows the opposite: credit standards are still getting easier and businesses are still trying to expand or capture market share regardless of the consequences down the road.

Bank Lending Survey

According to the April 2006 Senior Loan Officer Opinion Survey on Bank Lending Practices

On net, 12 percent of domestic institutions indicated that they had eased standards on business loans to large and middle-market firms.

About 60 percent of domestic respondents, a notably larger net fraction than in the previous survey, reported that they had trimmed spreads of loan rates over their cost of funds for such firms.

Almost 40 percent of domestic institutions, again a larger net fraction than in the January survey, indicated that they had reduced the costs of credit lines over the past three months.

About one-fifth of domestic banks, noted that they had increased the maximum maturity of C&I loans or credit lines that they were willing to extend to their business borrowers.

For C&I loans to small firms, 7 percent of domestic respondents noted that they had eased lending standards in the April survey.

On balance, almost 50 percent of respondents indicated that they had narrowed spreads of loan rates over their cost of funds.

About 30 percent of respondents reported having reduced the cost of credit lines over the same period.

Most respondents reporting easing of their lending standards cited more aggressive competition as an important reason for having done so.

Perhaps lending standards have changed given the market downdraft in equity markets in May but I doubt it. Note that housing starts were up this month even though inventories are skyrocketing and buyer traffic is back at 1990 levels. "Have Funding Will Build" seems to be the homebuilder motto of the day.Housing Starts

Here is another angle on housing starts:

Bloomberg is reporting Copper Rises After U.S. Housing Starts Gain More-Than-Expected.

Copper in London and Shanghai rose after home construction rebounded in the U.S. last month, spurring optimism for sustained demand in the world's second- biggest user of the metal.

Housing starts rose a greater-than-expected 5 percent to an annual rate of 1.957 million, the Commerce Department said yesterday in Washington. The average U.S. home contains about 400 pounds (181.4 kilograms) of copper wire and pipes, according to the New York-based Copper Development Association."

Prior to these numbers, there was some concern that the U.S. property market was cooling, but the announcement showed that is not the case," Cai Luoyi, a metals analyst at China International Futures (Shanghai) Co., said by phone.

So there was "some concern" about US housing but I see that one month of data removes all that concern. By any chance is Cai Luoyi the replacement for the rogue trader that cost China $200 million by shorting copper futures last year?

Flashback to November 25th. The Washington Post reported Losses on Copper Futures Have Leadership Spinning?

Fast forward to today:

There are now record numbers of unsold homes on the market. There were 565,000 new and 3.4 million existing residences for sale in April according to the National Association of Realtors and the Commerce Department. That is a lot of supply and home builders keep adding to it every month at a far faster pace than sales.Danielle DiMartino writing for the Dallas Morning News is asking Which builders will be left standing?

After I had mulled over the troubling 5 percent rise in May housing starts, a brilliantly simple explanation hit my inbox."Builders with no starts are 'unemployed,' " wrote James Bandy of Dallas, "and they will never be voluntarily unemployed."

Mr. Bandy said he recalls Texas in the mid-1980s well enough to recognize the sequel to the high-stakes game of musical chairs.Given that we all know how the game ends, it's hard to see why so many builders continue to be willing participants.

Yet they play on.

In case you've missed the most massive buildup since the Cold War, inventories of new and existing homes are at the highest levels ever recorded. Combine existing and new construction and you get a cool 4 million unsold units.

With this much supply, you'd think starts would be down by more than 3.8 percent from January's 33-year high.

Wouldn't it be smarter to show a bit of restraint and shelter what profit margins do remain? It's not as if retaining sales volumes to keep up appearances is still a legitimate excuse. Wall Street long ago pummeled homebuilder stocks.

In fact, the meltdown in share prices has freed homebuilders to shift their focus back to profits.

Rather than pile on more incentives to stanch plummeting demand, those with an eye on survival could simply cancel, or at least postpone, groundbreakings.

It's painfully apparent that, somewhere along the way, the industry abandoned concern for its customers' long-term well-being.

Maybe builders just don't appreciate how critical a role they play. Oversupply is but one issue when viewed in isolation – as is the risk to the labor market, as is the threat to the banking system.

Add them together, though, and we're not talking child's play. We're talking about a seriously brutal session of musical chairs.

One has to laugh about that musical chairs analogy but it goes beyond homebuilding into every aspect of this financial economy totally dependent on ever increasing amounts of risk. Not only are more and more players struggling to get into the game (with no additional chairs being added) those already in it are struggling to increase leverage.

…Let's look at one more interesting article from Danielle DiMartino. This one is called Not feeling at home with risk.

Three weeks ago the portfolio manager at Pacific Investment Management Co. sold his house and moved into an apartment with his wife. Though his wife wasn't exactly happy with the move, his sense is "she will look back on our sale and view it as a good one."Curiously, Mr. Kiesel's specialty is corporate bonds, which he says have given him a unique perspective on the U.S. housing market.

"Rising home prices have been the key driver of U.S. economic growth, which in turn has played a major role in the tightening of corporate bond spreads," Mr. Kiesel said.Many of these companies are buying back their stock, which weakens bondholders' cash cushion on the balance sheet. "

In this environment, bondholders should be demanding covenant protection as well as higher spreads on homebuilder bonds."

Because housing has driven the economy for so long, the slowdown will bring, among other things, tighter lending standards, less willingness to take risk, lower asset price appreciation outside housing, less liquid financial markets and rising volatility.

"At that point, 'For Sale' will not just be a sign you see in front of your neighbor's yard," Mr. Kiesel added. "Investors may also put a 'For Sale' sign on risk assets as well."

Judging from the huge swings we've seen in emerging markets, stocks and commodities in recent weeks, big institutional investors have already started to shift away from risk, something that carries deeper implications for bondholders.

Junk bond spreads are widening, the Fed is still hiking, housing inventory is soaring, but builders are still building, companies are still wasting cash on share buybacks at inflated prices, and credit standards amazingly are still headed lower. It's not readily apparent right now but I suspect there will be a severe shortage of chairs when Bernanke's Big Band stops the rate hike music.

0 Comments:

Post a Comment

<< Home