Signs of the Economic Apocalypse, 10-2-06

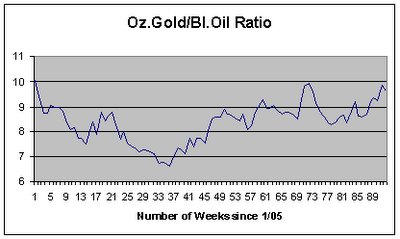

Gold closed at 603.60 dollars an ounce on Friday, up 1.5% from $594.90 at the close of the previous Friday. The dollar closed at 0.7890 euros Friday, up 0.9% from 0.7817 for the week. That put the euro at 1.2674 dollars compared to 1.2792 at the previous week’s close. Gold in euros would be 476.25 euros an ounce, up 2.4% from 465.06 for the week. Oil closed at 62.91 dollars a barrel Friday, up 4.4% from $60.28 at the end of the week before. Oil in euros would be 49.64 euros a barrel, up 5.3% from 47.12 for the week. The gold/oil ratio closed at 9.59, down 2.9% from 9.87 at the end of the previous week. In U.S. stocks the Dow closed at 11,679.07 Friday, apparently close to a record or something, up 1.5% from 11,508.10 at the close of the previous Friday. The NASDAQ closed at 2,258.43 (nowhere NEAR a record), up 1.8% from 2,218.93 at the close of the week before. In U.S. interest rates, the yield on the ten-year U.S. Treasury note closed at 4.63%, up four basis points from 4.59 for the week.

Friday was the end of the third quarter of 2006, so let’s look at the quarterly and year-to-date numbers. Gold fell 2.1% from $616.20 to $603.60 for the quarter but rose 16% from $519.70 for the year so far. The dollar rose 0.9% from 0.7819 euros to 0.7890 for the quarter, but fell 7.0% from 0.8440 euros for the year. Oil fell 17.4% from $73.85 a barrel to $62.91 for the quarter, but rose 3.1% from $61.04 for the year. In euros, oil dropped 16.3% from 57.74 to 49.64 euros an ounce for the quarter and dropped 3.6% from 51.43 for the year. Gold in euros dropped 1.2% from 481.78 euros an ounce to 476.25 for the quarter but rose 8.6% from 438.60 for the year. The gold/oil ratio rose 15.0% from 8.34 to 9.59 for the quarter and 12.7% from 8.51 for the year. The Dow rose 4.7% from 11,150.22 to 11,679.07 for the quarter and 9.0% from 10,717.50 for the first three quarters of 2006. The NASDAQ rose 4.0% from 2,172.09 to 2,258.43 for the quarter and 2.4% from 2,205.32 for the year. The yield on the ten-year U.S. Treasury note dropped 51 basis points from 5.14% to 4.63% for the quarter but rose 24 basis points from 4.39 for the year.

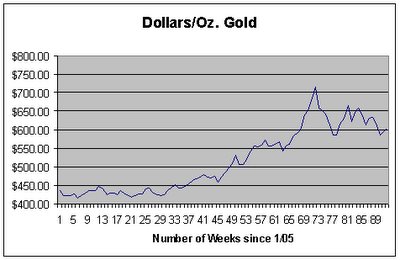

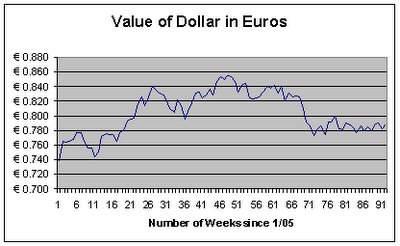

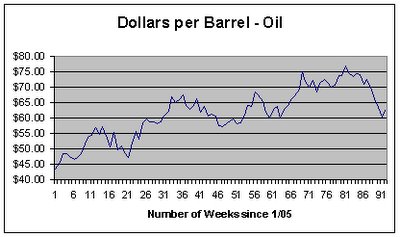

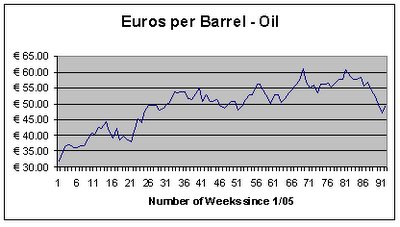

Here are charts of the trends going back to the beginning of 2005:

Gold and oil are up for the year but down for the third quarter of 2006. The dollar fell against 7% against the euro for the year 2006 to date, but has held steady in the third quarter. U.S. stocks are up for the year and the quarter, while long-term interest rates have risen for the quarter but fallen sharply for the year.

The third quarter, then, has seen encouraging numbers for the U.S. imperial economy, despite the larger context of massive debt-fueled imbalances and disastrous news on the military front.

The past week saw the relese of numbers showing a clear slowing of the U.S. economy. But the stock market seemed to view that as good news for interest rates. The mainstream media saw more evidence that a “soft landing” (sounds nice, doesn’t it?) can be achieved:

Wall Street demands, what slowdown?

by Claire Gallen

Sat Sep 30, 11:25 PM ETWASHINGTON (AFP) - To judge by the excitement on Wall Street, the US economy is in the rudest of health. The paradox is that the economy is posting some of its slowest growth rates in five years.

After relying for years on a booming housing market to generate wealth, US consumers are curbing their spending. With property sales and prices now sagging, one of the props to a post-2001 expansion has been removed.

However, according to analysts, other props remain that will limit the downside to the world's biggest economy heading into the final quarter of 2006.

Corporate earnings have remained strong and cash-rich companies are in sound financial shape, "and that's one of the best bits of news for the US economy", Global Insight chief economist Nariman Behravesh said.

Even if some domestic sectors like housing are slowing, foreign demand for US goods is building as growth in Europe and Japan finally picks up. And if the residential market has cooled, commercial property is as strong as ever.

A robust outlook for earnings has lifted Wall Street to levels last seen during the dot-com boom of the late 1990s. A widespread belief that the Federal Reserve will keep interest rates steady for the time being has helped.

On Friday, the Dow Jones index of blue-chip shares finished at 11,679.07, in sight of its all-time closing high of 11,722.98 reached in January 2000.

Once the Internet mania collapsed, the US economy slipped into recession in 2001. The current housing downturn has led some observers to fret anew about the "R" word.

But according to Behravesh, those fears are misplaced.

"If you really look at all recessions, we never had a housing-led recession. A recession is exacerbated by the housing downturn," he said.

"What happens is that the Fed is worried by inflation, they raise rates and it kills the economy -- and housing."

The US central bank does have plenty to worry about on the inflation front. Even as national growth has waned from 5.6 percent in the first quarter to 2.6 percent in the second, price pressures have continued to build.

Data out Friday showed the core inflation rate linked to consumer spending, excluding food and energy prices, rose to 2.5 percent on an annualised basis in August, the biggest monthly rise April 1995.

Years of sky-high oil prices would appear now to be feeding through to the wider US economy, as companies feel emboldened to pass on price rises to their customers.

But Friday's figures also showed household incomes rising faster than spending, Joel Naroff of Naroff Economic Advisors noted.

"Clearly, the consumer spending binge is coming to an end. With households dipping into savings for over a year, that is not surprising," he said.

"That plays into the Fed's argument that a moderating economy will restrain inflation."

Most of the betting on Wall Street is that the Fed, after calling off a long-running campaign of rate hikes in August, will hold pat for some months before cutting borrowing costs next year.

"Oil prices have been tripling, and my guess is that the signs of inflation are all related to this, and this is a very unusual thing," JP Morgan Chase managing director Jim Glassman said.

"The Fed is gradually coming to the view that that's not an inflation story," he said.

If the central bank does switch its bias to cutting rates, Wall Street can be expected to shrug off any anxiety over consumer spending to extend its record-breaking rally.

"If inflation is not an issue, it allows the markets to respond more promptly to any signs of (economic) weakness," Glassman said, noting that corporate profits were growing fast enough to outstrip any housing downside.

Can the news really be this good? Maybe, but only if you put blinders on and ignore the world political situation. Those who can’t ignore the reckless policies of the U.S. imperial leadership and the consequent fiscal and trade imbalances can take little solace in the hopes of a soft landing or even of a short, mild recession. Our fates over the next year or two will not be determined by purely economic factors.

And even those who can put the blinders on politically feel unease about military quagmires, climate change, and eroding standards of living. According to the Center for American progress, the situation for the middle class is worse than it has been in recent memory:

Middle-class families in worse shape than ever, study finds

Typical families have not stashed enough money; struggling to pay for home, insurance, and education according to Center for American Progress.

September 28 2006

WASHINGTON (Reuters) -- The typical double-income family is worse off financially than ever, a study released Thursday said, warning that few Americans have saved enough to brace for financial setbacks.

Middle-class families are struggling to pay for a home, health insurance, transportation and their children's college with wages that have not kept pace with higher prices, according to the study by a think tank headed by a former top aide to President Bill Clinton.

The middle class's financial condition has been a key issue ahead of the November elections, as Democrats warn that this group is fast losing economic ground amid skyrocketing prices and tax cuts that offer them little benefit.

"In our estimates, it's becoming harder for families to afford what we consider a typical middle-class lifestyle," said economist Christian Weller of the Center for American Progress, the political think tank headed by John Podesta, a former Clinton chief of staff.

Weller cautioned that while Americans are taking on more debt to cover higher costs, wages have not kept pace.

The majority of Americans have not socked away enough money to brace for financial setbacks such as a job loss or a medical emergency.

According to the study, less than a third of all American families have accumulated income equaling three months of their wages. The trend is particularly pronounced among the 60 percent income distribution that makes up the middle class: those with dual incomes earning from $18,500 to $88,030 a year.

From 2001 to 2004, the proportion of middle-class families that has saved three months' worth of income dropped to 18.3 percent from 28.8 percent, the study said.

Higher prices for a range of things - including health care, energy, transportation, food and education - have put Americans in this position as corporate profits have risen, the study said.It said, that five years into the current economic recovery, average job growth is one-fifth that of previous business cycles and wages are flat when inflation is factored into the equation.

To maintain day-to-day consumption, families have taken on a record amount of debt, equal to 126.4 percent of disposable income in the first quarter of 2006, according to the study.

Commenting on the study, SEIU Labor Union President Andy Stern said, "Of the total amount of our economy and income, we have the greatest share going to profits in modern history and the least amount going to wages in modern history."

"For most working Americans, things are far worse than any time certainly in recent history and at a time of an incredibly growing economy." said Stern, whose union represents 1.1 million health care workers.

Why then, the good news on the financial pages and the sense of forboding everywhere else? Because the future may actually be looking good for those who own the economy. The savings from lower wages paid to the middle classes in the developed countries have gone straight to corporate profits. The interest paid on consumer debt goes staight to the hands of the owners as well. Furthermore, the loss of our liberties from the phony war on terrorism can only help them exploit us more.

Paul Craig Roberts spells it out:

As Jobs Leave America's Shores...

The New Face of Class War

By Paul Craig Roberts

September 30 / October 1, 2006

The attacks on middle-class jobs are lending new meaning to the phrase "class war". The ladders of upward mobility are being dismantled. America, the land of opportunity, is giving way to ever deepening polarization between rich and poor.

The assault on jobs predates the Bush regime. However, the loss of middle-class jobs has become particularly intense in the 21st century, and, like other pressing problems, has been ignored by President Bush, who is focused on waging war in the Middle East and building a police state at home. The lives and careers that are being lost to the carnage of a gratuitous war in Iraq are paralleled by the economic destruction of careers, families, and communities in the U.S.A. Since the days of President Franklin D. Roosevelt in the 1930s, the U.S. government has sought to protect employment of its citizens. Bush has turned his back on this responsibility. He has given his support to the offshoring of American jobs that is eroding the living standards of Americans. It is another example of his betrayal of the public trust.

"Free trade" and "globalization" are the guises behind which class war is being conducted against the middle class by both political parties. Patrick J. Buchanan, a three-time contender for the presidential nomination, put it well when he wrote that NAFTA and the various so-called trade agreements were never trade deals. The agreements were enabling acts that enabled U.S. corporations to dump their American workers, avoid Social Security taxes, health care and pensions, and move their factories offshore to locations where labor is cheap.

The offshore outsourcing of American jobs has nothing to do with free trade based on comparative advantage. Offshoring is labor arbitrage. First world capital and technology are not seeking comparative advantage at home in order to compete abroad. They are seeking absolute advantage abroad in cheap labor.

Two recent developments made possible the supremacy of absolute over comparative advantage: the high speed Internet and the collapse of world socialism, which opened China's and India's vast under-utilized labor resources to first world capital.

In times past, first world workers had nothing to fear from cheap labor abroad. Americans worked with superior capital, technology and business organization. This made Americans far more productive than Indians and Chinese, and, as it was not possible for U.S. firms to substitute cheaper foreign labor for U.S. labor, American jobs and living standards were not threatened by low wages abroad or by the products that these low wages produced.

The advent of offshoring has made it possible for U.S. firms using first world capital and technology to produce goods and services for the U.S. market with foreign labor. The result is to separate Americans' incomes from the production of the goods and services that they consume. This new development, often called "globalization," allows cheap foreign labor to work with the same capital, technology and business know-how as U.S. workers. The foreign workers are now as productive as Americans, with the difference being that the large excess supply of labor that overhangs labor markets in China and India keeps wages in these countries low. Labor that is equally productive but paid a fraction of the wage is a magnet for Western capital and technology.

Although a new development, offshoring is destroying entire industries, occupations and communities in the United States. The devastation of U.S. manufacturing employment was waved away with promises that a "new economy" based on high-tech knowledge jobs would take its place. Education and retraining were touted as the answer.

In testimony before the U.S.-China Commission, I explained that offshoring is the replacement of U.S. labor with foreign labor in U.S. production functions over a wide range of tradable goods and services. (Tradable goods and services are those that can be exported or that are competitive with imports. Nontradable goods and services are those that only have domestic markets and no import competition. For example, barbers and dentists offer nontradable services. Examples of nontradable goods are perishable, locally produced fruits and vegetables and specially fabricated parts of local machine shops.) As the production of most tradable goods and services can be moved offshore, there are no replacement occupations for which to train except in domestic "hands on" services such as barbers, manicurists, and hospital orderlies. No country benefits from trading its professional jobs, such as engineering, for domestic service jobs.

At a Brookings Institution conference in Washington, D.C., in January 2004, I predicted that if the pace of jobs outsourcing and occupational destruction continued, the U.S. would be a third world country in 20 years. Despite my regular updates on the poor performance of U.S. job growth in the 21st century, economists have insisted that offshoring is a manifestation of free trade and can only have positive benefits overall for Americans.

Reality has contradicted the glib economists. The new high-tech knowledge jobs are being outsourced abroad even faster than the old manufacturing jobs. Establishment economists are beginning to see the light. Writing in Foreign Affairs (March/April 2006), Princeton economist and former Federal Reserve vice chairman Alan Blinder concludes that economists who insist that offshore outsourcing is merely a routine extension of international trade are overlooking a major transformation with significant consequences. Blinder estimates that 42-56 million American service sector jobs are susceptible to offshore outsourcing. Whether all these jobs leave, U.S. salaries will be forced down by the willingness of foreigners to do the work for less.

Software engineers and information technology workers have been especially hard hit. Jobs offshoring, which began with call centers and back-office operations, is rapidly moving up the value chain. Business Week's Michael Mandel compared starting salaries in 2005 with those in 2001. He found a 12.7 per cent decline in computer science pay, a 12 per cent decline in computer engineering pay, and a 10.2 per cent decline in electrical engineering pay. Marketing salaries experienced a 6.5 per cent decline, and business administration salaries fell 5.7 per cent. Despite a make-work law for accountants known by the names of its congressional sponsors, Sarbanes-Oxley, even accounting majors, were offered 2.3 per cent less.

Using the same sources as the Business Week article (salary data from the National Association of Colleges and Employers and Bureau of Labor Statistics data for inflation adjustment), professor Norm Matloff at the University of California, Davis, made the same comparison for master's degree graduates. He found that between 2001 and 2005 starting pay for master's degrees in computer science, computer engineering, and electrical engineering fell 6.6 per cent, 13.7 per cent, and 9.4 per cent respectively.

On February 22, 2006, CNNMoney.com staff writer Shaheen Pasha reported that America's large financial institutions are moving "large portions of their investment banking operations abroad." Offshoring is now killing American jobs in research and analytic operations, foreign exchange trades, and highly complicated credit derivatives contracts. Deal-making responsibility itself may eventually move abroad. Deloitte Touche says that the financial services industry will move 20 per cent of its total costs base offshore by the end of 2010. As the costs are lower in India, the move will represent more than 20 per cent of the business. A job on Wall Street is a declining option for bright young persons with high stress tolerance as America's last remaining advantage is outsourced.

According to Norm Augustine, former CEO of Lockheed Martin, even McDonald jobs are on the way offshore. Augustine reports that McDonald is experimenting with replacing error-prone order takers with a system that transmits orders via satellite to a central location and from there to the person preparing the order. The technology lets the orders be taken in India or China at costs below the U.S. minimum wage and without the liabilities of U.S. employees.

American economists, some from incompetence and some from being bought and paid for, described globalization as a "win-win" development. It was supposed to work like this: The U.S. would lose market share in tradable manufactured goods and make up the job and economic loss with highly educated knowledge workers. The win for America would be lower-priced manufactured goods and a white-collar work force. The win for China would be manufacturing jobs that would bring economic development to that country.

It did not work out this way, as Morgan Stanley's Stephen Roach, formerly a cheerleader for globalization, recently admitted. It has become apparent that job creation and real wages in the developed economies are seriously lagging behind their historical norms as offshore outsourcing displaces the "new economy" jobs in "software programming, engineering, design, and the medical profession, as well as a broad array of professionals in the legal, accounting, actuarial, consulting, and financial services industries". The real state of the U.S. job market is revealed by a Chicago Sun-Times report on January 26, 2006, that 25,000 people applied for 325 jobs at a new Chicago Wal-Mart.

According to the BLS payroll jobs data, over the past half-decade (January 2001 - January 2006, the data series available at time of writing) the U.S. economy created 1,050,000 net new private sector jobs and 1,009,000 net new government jobs for a total five-year figure of 2,059,000. That is seven million jobs short of keeping up with population growth, definitely a serious job shortfall.

The BLS payroll jobs data contradict the hype from business organizations, such as the U.S. Chamber of Commerce, that offshore outsourcing is good for America. Large corporations, which have individually dismissed thousands of their U.S. employees and replaced them with foreigners, claim that jobs outsourcing allows them to save money that can be used to hire more Americans. The corporations and the business organizations are very successful in placing this disinformation in the media. The lie is repeated everywhere and has become a mantra among no-think economists and politicians. However, no sign of these jobs can be found in the payroll jobs data. But there is abundant evidence of the lost American jobs.

During the past five years (January 01 - January 06), the information sector of the U.S. economy lost 644,000 jobs, or 17.4 per cent of its work force. Computer systems design and related work lost 105,000 jobs, or 8.5 per cent of its work force. Clearly, jobs offshoring is not creating jobs in computers and information technology. Indeed, jobs offshoring is not even creating jobs in related fields.U.S. manufacturing lost 2.9 million jobs, almost 17 per cent of the manufacturing work force. The wipeout is across the board. Not a single manufacturing payroll classification created a single new job.

The declines in some manufacturing sectors have more in common with a country undergoing saturation bombing during war than with a "supereconomy" that is "the envy of the world." In five years, communications equipment lost 42 per cent of its work force. Semiconductors and electronic components lost 37 per cent of its work force . The work force in computers and electronic products declined 30 per cent. Electrical equipment and appliances lost 25 per cent of its employees. The work force in motor vehicles and parts declined 12 per cent. Furniture and related products lost 17 per cent of its jobs. Apparel manufacturers lost almost half of the work force. Employment in textile mills declined 43 per cent. Paper and paper products lost one-fifth of its jobs. The work force in plastics and rubber products declined by 15 per cent.

For the five-year period, U.S. job growth was limited to four areas: education and health services, state and local government, leisure and hospitality, and financial services. There was no U.S. job growth outside these four areas of domestic nontradable services.

Oracle, for example, which has been handing out thousands of pink slips, has recently announced two thousand more jobs being moved to India. How is Oracle's move of U.S. jobs to India creating American jobs in nontradable services such as waitresses and bartenders, hospital orderlies, state and local government, and credit agencies?

Engineering jobs in general are in decline, because the manufacturing sectors that employ engineers are in decline. During the last five years, the U.S. work force lost 1.2 million jobs in the manufacture of machinery, computers, electronics, semiconductors, communication equipment, electrical equipment, motor vehicles, and transportation equipment. The BLS payroll jobs numbers show a total of 69,000 jobs created in all fields of architecture and engineering, including clerical personnel, over the past five years. That comes to a mere 14,000 jobs per year (including clerical workers). What is the annual graduating class in engineering and architecture? How is there a shortage of engineers when more graduate than can be employed?

…All of the occupations with the largest projected employment growth (in terms of the number of jobs) over the next decade are in nontradable domestic services. The top ten sources of the most jobs in "superpower" America are: retail salespersons, registered nurses, postsecondary teachers, customer service representatives, janitors and cleaners, waiters and waitresses, food preparation (includes fast food), home health aides, nursing aides, orderlies and attendants, general and operations managers. Note than none of this projected employment growth will contribute one nickel toward producing goods and services that could be exported to help close the huge U.S. trade deficit. Note, also, that few of these job classifications require a college education.

Among the fastest growing occupations (in terms of rate of growth), seven of the ten are in health care and social assistance. The three remaining fields are: network systems and data analysis with 126,000 jobs projected, or 12,600 per year; computer software engineering applications with 222,000 jobs projected, or 22,200 per year; and computer software engineering systems software with 146,000 jobs projected, or 14,600 per year.

Assuming these projections are realized, how many of the computer engineering and network systems jobs will go to Americans? Not many, considering the 65,000 H-1B visas each year (bills have been introduced in Congress to raise the number) and the loss during the past five years of 761,000 jobs in the information sector and computer systems design and related sectors.

Judging from its ten-year jobs projections, the U.S. Department of Labor does not expect to see any significant high-tech job growth in the U.S. The knowledge jobs are being outsourced even more rapidly than the manufacturing jobs. The so-called "new economy" was just another hoax perpetrated on the American people.

If outsourcing jobs offshore is good for U.S. employment, why won't the U.S. Department of Commerce release the 200-page, $335,000 study of the impact of the offshoring of U.S. high-tech jobs? Republican political appointees reduced the 200-page report to 12 pages of public relations hype and refuse to allow the Technology Administration experts who wrote the report to testify before Congress. Democrats on the House Science Committee are unable to pry the study out of the hands of Commerce Secretary Carlos Gutierrez. On March 29, 2006, Republicans on the House Science Committee voted down a resolution (H.Res. designed to force the Commerce Department to release the study to Congress. Obviously, the facts don't fit the Bush regime's globalization hype.

…Clearly, engineering and computer-related employment in the U.S.A. has not been growing, whether measured by industry or by occupation. Moreover, with a half million or more foreigners in the U.S. on work visas, the overall employment numbers do not represent employment of Americans.

American employees have been abandoned by American corporations and by their representatives in Congress. America remains a land of opportunity but for foreigners not for the native born. A country whose work force is concentrated in domestic nontradable services has no need for scientists and engineers and no need for universities. Even the projected jobs in nursing and school teaching can be filled by foreigners on H-1B visas.

The myth has been firmly established here that the jobs the U.S. is outsourcing offshore are being replaced with better jobs. There is no sign of these jobs in the payroll jobs data or in the occupational employment statistics. When a country loses entry-level jobs, it has no one to promote to senior level jobs. When manufacturing leaves, so does engineering, design, research and development, and innovation itself.

On February 16, 2006, the New York Times reported on a new study presented to the National Academies that concludes that outsourcing is climbing the skills ladder. A survey of 200 multinational corporations representing 15 industries in the U.S.and Europe found that 38 per cent planned to change substantially the worldwide distribution of their research and development work, sending it to India and China. According to the New York Times, "More companies in the survey said they planned to decrease research and development employment in the United States and Europe than planned to increase employment."

The study and the discussion it provoked came to untenable remedies. Many believe that a primary reason for the shift of R&D to India and China is the erosion of scientific prowess in the U.S. due to lack of math and science proficiency of American students and their reluctance to pursue careers in science and engineering. This belief begs the question why students would chase after careers that are being outsourced abroad.

The main author of the study, Georgia Tech professor Marie Thursby, believes that American science and engineering depend on having "an environment that fosters the development of a high-quality work force and productive collaboration between corporations and universities." The dean of Engineering at the University of California, Berkeley, thinks the answer is to recruit the top people in China and India and bring them to Berkeley. No one seems to understand that research, development, design, and innovation take place in countries where things are made. The loss of manufacturing means ultimately the loss of engineering and science. The newest plants embody the latest technology. If these plants are abroad, that is where the cutting edge resides.

The denial of jobs reality has become an art form for economists, libertarians, the Bush regime, and journalists. Except for CNN's Lou Dobbs, no accurate reporting is available in the "mainstream media."

Economists have failed to examine the incompatibility of offshoring with free trade. Economists are so accustomed to shouting down protectionists that they dismiss any complaint about globalization's impact on domestic jobs as the ignorant voice of a protectionist seeking to preserve the buggy whip industry. Matthew J. Slaughter, a Dartmouth economics professor rewarded for his service to offshoring with appointment to President Bush's Council of Economic Advisers, suffered no harm to his reputation when he wrote, "For every one job that U.S. multinationals created abroad in their foreign affiliates, they created nearly two U.S. jobs in their parent operations." In other words, Slaughter claims that offshoring is creating more American jobs than foreign ones.

How did Slaughter arrive at this conclusion? Not by consulting the BLS payroll jobs data or the BLS Occupational Employment Statistics. Instead, Slaughter measured the growth of U.S. multinational employment and failed to take into account the two reasons for the increase in multinational employment: (1) Multinationals acquired many existing smaller firms, thus raising multinational employment but not overall employment, and (2) many U.S. firms established foreign operations for the first time and thereby became multinationals, thus adding their existing employment to Slaughter's number for multinational employment.

ABC News' John Stossel, a libertarian hero, recently made a similar error. In debunking Lou Dobbs' concern with U.S. jobs lost to offshore outsourcing, Stossel invoked the California-based company, Collabnet. He quotes the CEO's claim that outsourcing saves his company money and lets him hire more Americans. Turning to Collabnet's webpage, it is very instructive to see the employment opportunities that the company posts for the United States and for India.

In India, Collabnet has openings (at time of writing) for eight engineers, a sales engineer, a technical writer, and a telemarketing representative. In the U.S. Collabnet has openings for one engineer, a receptionist/office assistant, and positions in marketing, sales, services and operations. Collabnet is a perfect example of what Lou Dobbs and I report: the engineering and design jobs move abroad, and Americans are employed to sell and market the foreign-made products.

Other forms of deception are widely practiced. For example, Matthew Spiegleman, a Conference Board economist, claims that manufacturing jobs are only slightly higher paid than domestic service jobs, so there is no meaningful loss in income to Americans from offshoring. He reaches this conclusion by comparing only hourly pay and leaving out the longer manufacturing workweek and the associated benefits, such as health care and pensions.

Occasionally, however, real information escapes the spin machine. In February 2006 the National Association of Manufacturers, one of offshoring's greatest boosters, released a report, "U.S. Manufacturing Innovation at Risk," by economists Joel Popkin and Kathryn Kobe.16 The economists find that U.S. industry's investment in research and development is not languishing after all. It just appears to be languishing, because it is rapidly being shifted overseas: "Funds provided for foreign-performed R&D have grown by almost 73 per cent between 1999 and 2003, with a 36 per cent increase in the number of firms funding foreign R&D."

U.S. industry is still investing in R&D after all; it is just not hiring Americans to do the research and development. U.S. manufacturers still make things, only less and less in America with American labor. U.S. manufacturers still hire engineers, only they are foreign ones, not American ones.

In other words, everything is fine for U.S. manufacturers. It is just their former American work force that is in the doldrums. As these Americans happen to be customers for U.S. manufacturers, U.S. brand names will gradually lose their U.S. market. U.S. household median income has fallen for the past five years. Consumer demand has been kept alive by consumers' spending their savings and home equity and going deeper into debt. It is not possible for debt to forever rise faster than income.

The United States is the first country in history to destroy the prospects and living standards of its labor force. It is amazing to watch freedom-loving libertarians and free-market economists serve as apologists for the dismantling of the ladders of upward mobility that made the America of old an opportunity society.

America is seeing a widening polarization into rich and poor. The resulting political instability and social strife will be terrible.

0 Comments:

Post a Comment

<< Home