Signs of the Economic Apocalypse, 7-24-06

Gold closed at 621.20 on Friday, down 7.1% from $665.40 at the end of the previous week. The dollar closed at 0.7877 euros Friday, down 0.3% from 0.7904 for the week. The euro closed at 1.2695 dollars on Friday compared to 1.2652 at the close of the previous Friday. Gold in euros would be 489.33, down 7.5% from 525.92 for the week. Oil closed at 74.43 dollars a barrel this week, down 3.2% from $76.80 at the end of the week before. Oil in euros would be 58.63 euros a barrel, down 3.5% from 60.70 for the week. The gold/oil ratio closed at 8.35 Friday, down 3.7% from 8.66 at the close of the previous Friday. In U.S. stocks, the Dow Jones Industrial Average closed at 10,876.71, up 1.3% from 10,739.35 for the week. The NASDAQ closed at 2,021.68 on Friday, down 0.8% from 2,037.35 at the end of the week before. In U.S. interest rates, the yield on the ten-year U.S. Treasury note closed at 5.04%, down two basis points from 5.06 for the week.

In spite of the frightening events taking place in Lebanon, Palestine, Iraq and Afghanistan, world markets continue to act as if they are being propped up. Gold fell sharply last week, about 7%, and oil fell about 3%. Of course, these drops were from highs last Friday that were reached as the implications of what Israel and the United States are doing became apparent. It seems that things are getting so crazy lately that crazy is the norm. Shocks wear off way too soon. If you could go in a time machine and visit your own self of six years ago, would you even believe what would take place? But since then we have become accustomed to global mayhem. Another reason for the lack of panic in U.S. markets, anyway, is the fact that the U.S. media has completely taken the side of Israel and is trying to portray the criminal attack as some sort of normal, justified defensive “operation.”

We have discussed the slow nature of the world economic and political collapse. It is slow enough that the word ‘collapse’ might seem inappropriate. George Ure makes an important point about what he calls the “piecemeal collapse:”

[T]here's a way that complex systems can degrade in piecemeal fashion, rather than single points of failure (SPF's) in such a way that the system collapses anyway. A couple of reasons to mention this, beyond my early subscriber paper "Death by JIT" and the recent mentions in the web bot runs about JIT being a factor in emerging "shortages": One is the power outages that have cropped up around the country including Queens, New York, and the St. Louis area. It's something for you to noodle on: How many small "piecemeal" collapses does it take before larger complex systems seriously degrade? And, how many people end up starving if a power outage (heat induced) were to hit at the peak of the picking/canning season in America's food belt states?

Molly Ivins last week wrote about the hedge funds/derivatives problem:

The Suicide of Capitalism

Posted on Jul 17, 2006

By Molly Ivins

Editor’s note: In this column, Molly Ivins notes that when the Long Term Capital Management hedge fund went belly up in 1998, it nearly wrecked world markets. So why, she wonders, are we allowing well-connected Republicans to prevent the SEC from staving off the next catastrophe?

AUSTIN, Texas—In case you haven’t got anything else to worry about—like war in the Middle East, nuclear showdowns, global warming or Apocalypse Now—how about the suicide of capitalism?

Late last month, the U.S. Court of Appeals struck down a new rule by the Securities and Exchange Commission requiring mandatory registration with the SEC for most hedge funds. This may not strike you as the end of the world, but that’s because you’ve either forgotten what a hedge fund is or how much trouble the funds can get us into.

These investment pools for rich folks are now a $1.2-trillion industry (known to insiders, I am pleased to report, as “the hedge fund community"). Hedge funds are now beginning to be used by average investors and pension investors. Back in 1998, there was this little-bitty old hedge fund called Long Term Capital Management. Because hedge funds make high-risk bets, Long Term Capital got itself in so much trouble its collapse actually threatened to wreck world markets, and regulators had to step in to negotiate a $3.6-billion bailout. A similar fiasco at this point probably would break world markets.

The Securities and Exchange Commission under William Donaldson (appointed after the Enron mess) had tried to regulate hedge funds. But Christopher Cox, current SEC chairman and no friend of regulation, said he would consult other members of the administration about whether to appeal the ruling, which “came on the same day as disclosures,” reports The Washington Post, that the feds “are investigating Pequot Capital Management, Inc., a $7 billion hedge fund, for possible insider trading.” Nice timing, judges.

This is the third time in less than a year the appeals court has blocked the SEC from acting beyond its authority. According to The Washington Post, “Former SEC member Harvey J. Goldschmid, who voted to approve the plan, yesterday urged regulators to appeal to the U.S. Supreme Court, members of Congress or both. In the Pequot case, a former SEC lawyer who worked on the Pequot investigation before being fired by the agency has written a letter to key members of the Senate banking and finance committees alleging that the SEC dropped the probe because of political pressure.” The lawyer said he was prevented by political pressure from interviewing a top Wall Street executive. Sources said the executive was John J. Mack, once chairman of Pequot and now chief executive of Morgan Stanley—and a major fundraiser for President Bush’s campaigns. I’d say the guy’s wired.

So what we have here is yet another case of ideological decision-making ("all government regulation is bad") being applied despite the most obvious promptings of common sense. Come to think of it, that’s exactly the pattern this administration has followed with war in the Middle East, nuclear showdowns, global warming and Apocalypse Now…

Actually, to give the devil his due, such a calling off of investigations into hedge funds is another example of how the world economy is being propped up by temporary measures. In other words, the investigation might cause what would be a normally healthy crash in hedge funds while calling off any regulation or investigation can buy a little time.

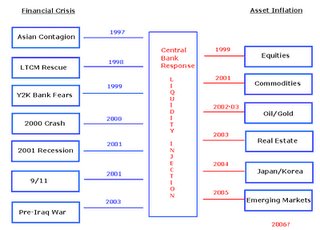

Here is a good graph that shows exactly how the world economy has been kept afloat for far longer than most of us doomsayers could have predicted: liquidity injections! And large hedge funds are a covert way for central banks to inject massive liguidity into markets, since they are seen as “too big too fail” and hence backed by central banks. Central banks have several ways to use large hedge funds for this purpose.

Now if the underlying factors all point to collapse, it can’t be propped up indefinitely, but it is starting to seem as if it is being sustained at current levels until something else of immense catastrophic importance takes place. In other words, the Powers that Be in normal times might already have pulled the world economy in the usual controlled demolition. But these aren’t normal times. If they know that something ELSE is coming, they do have the ability to keep things afloat for a few extra years. The question then becomes what is that something else? Candidates include: world war which goes nuclear, climate change leading to massive food shortages, earthquakes, meteor impacts, plagues, etc. They don’t call them the Four Horsemen of the Apocalypse for nothing.

All the usual idiots on United States Television are now talking excitedly about how World War Three has started. They shouldn’t be so excited because if it is the United States/Isreal will lose, and, as they are losing will be tempted to unleash nuclear holocaust. The blogger Billmon has this scenario:

Losing an Army

Earlier this week I linked to a commentary from William S. Lind in which he warned that war with Iran could result in the loss of the 140,000 man army America currently has bogged down in Iraq. This may have seemed far-fetched, given the enormous military disparity between the two sides. But Col. Pat Lang, a former intelligence officer, explains how and why it could happen:American troops all over central and northern Iraq are supplied with fuel, food, and ammunition by truck convoy from a supply base hundreds of miles away in Kuwait. All but a small amount of our soldiers' supplies come into the country over roads that pass through the Shiite-dominated south of Iraq . . .

Southern Iraq is thoroughly infiltrated by Iranian special operations forces working with Shiite militias, such as Moqtada al-Sadr's Mahdi Army and the Badr Brigades. Hostilities between Iran and the United States or a change in attitude toward US forces on the part of the Baghdad government could quickly turn the supply roads into a "shooting gallery" 400 to 800 miles long.

(Christian Science Monitor, via No Quarter)There's a saying: Amateurs talk strategy; professionals talk logistics. And in the case of the U.S. Army, they talk it about a lot. This has been true almost as long as there's been a U.S. Army. During the 1944-45 campaign in Europe, for example, each U.S. division consumed 650 tons of food, gas, ammo and other supplies per day -- roughly three times what the German Army managed to get by on. Logistical requirements have only exploded since then. Those lobster tails they're eating at Camp Victory don't grow on the trees.

If the supply lines back to Kuwait were to be cut -- or even seriously interdicted -- the U.S. military presence in Iraq would quickly become untenable. I'm not even sure the Army could scrounge enough gas to keep the tanks and Humvees moving, given that Iraq already suffers from a severe refining capacity shortage and must import most of its gasoline from Kuwait.

As Lang explains, an Army that loses its logistical "tail" quickly begins to lose combat effectiveness:Without a plentiful and dependable source of fuel, food, and ammunition, a military force falters. First it stops moving, then it begins to starve, and eventually it becomes unable to resist the enemy.Centcom could, of course, try to resupply forces from the air, ala the Berlin Airlift, but Lang is dubious whether that would prove any more effective than the German attempt to do the same thing for its beleaguered forces at Stalingrad:

In a difficult situation, the tonnages delivered could be increased, but given the bulk in weight and volume of the needed supplies, it seems unlikely that air resupply could exceed 25 percent of daily requirements. This would not be enough to sustain the force.In other words, in the event of a real world war -- as opposed to the kind that pundits pontificate about on Fox News -- Centcom would either have to "pacify" the transportation routes through southern Iraq quickly and ruthlessly (which might not be possible, given the troops available and the possibility some Iraqi units might turn on their putative allies) or try to evacuate some or most U.S. forces from Iraq, either by air or ground.We're talking, on other words, about a potential debacle -- the worst U.S. military defeat since Pearl Harbor. Not because the Iranians are brilliant strategists or tough fighters (although they may be; we really don't know) but because the Iraq occupation has left the U.S. Army dangerously overextended, given its massive supply requirements.

Way back at the beginning of this war, I remember reading a quote from Air Force Col. John Warden, who fretted that the invasion and occupation of Iraq would leave the U.S. military holding "a very narrow beachhead in the midst of a billion undefeated Muslims." You don't have to buy into Warden's grandiose clash-of-civilization rhetoric to see how relevant his point may be now.

Last word this week on the war to George Ure again:

Pull up a chair and let's have us a nice friendly conversation about killing people. I don't usually suggest spending much time thinking the unthinkable, but given that there's now a better than even chance that the US will get sucked into an unwanted war with Iran due to Israeli's arguably over-zealous strikes on Gaza and Lebanon, at a time when US-based neocons have been pushing for just such events (ostensibly to support Israel, but coincident with republicorps in trouble in the fall elections here), now's as good a time as any to talk about killing humans. Besides the news events in the Middle East, don't forget that the http://www.halfpasthuman.com/ web bot project sees rebellion/revolution breaking out around September 1st, and a Dow stricken to 1-10th - to as little as 1/-10th its (present) value by year's end. I'll try to stay to the economic track here, but remember: War is a generalized state of conflict and your first job when it breaks out is to figure out how to stay alive for the duration of the conflict. Your second job is to secure safety of your family and loved ones as best you can. Your third job is to know how to survive afterwards. And last, but not least, there's the need to retain knowledge. Like the old saying goes, "WW III will be fought with nukes. WW IV will be fought with sticks and stones." So this week, our three core concepts are: the selectorate theory of war, Self Organizing Collectives, and Knowledge Preservation.

0 Comments:

Post a Comment

<< Home